Understanding What a Data Room for Investors Is: The Essential 2025 Guide

Introduction

In 2025’s fast-moving fundraising environment, a secure, well-organized virtual data room (VDR) is no longer a nice-to-have—it’s mission-critical. Whether you’re raising a seed round, closing a growth equity deal, or prepping for M&A, the investor data room is how you present financials, legal docs, product and ops details, and commercial traction in one secure, searchable, auditable place.

Modern VDRs are being reshaped by cloud-native architectures, AI, and machine learning. The latest platforms deliver bank-grade security, fine-grained permissions, automated redaction, and analytics that show who viewed what and when. These capabilities accelerate due diligence, reduce friction for investors, and improve close rates—a real edge in competitive processes where speed, transparency, and trust decide outcomes.

This guide explains what an investor data room is, the benefits, the core features, how to build one, what to include, best practices, security measures, common use cases, and how to choose the right provider—plus checklists, a ready-to-copy folder structure, and FAQs.

What Is a Data Room for Investors?

A data room for investors (often called a virtual data room or VDR) is a secure online repository where companies store and share confidential information with prospective investors and acquirers during fundraising, due diligence, M&A, secondary transactions, and IPO prep.

A great investor VDR:

-

Centralizes financial, legal, product, team, and market information

-

Controls access via roles, groups, and granular permissions

-

Tracks activity (views, downloads, time on page) for deal intelligence

-

Protects content with encryption, watermarking, DRM, and 2FA/MFA

-

Scales from pre-term-sheet sharing to full confirmatory diligence

Why investors value it

-

A complete view of the company (financial health, strategy, risks)

-

Faster evaluation and fewer email back-and-forths

-

Audit trails for compliance and internal IC (investment committee) review

Key Benefits of Using an Investor Data Room

-

Faster due diligence

Single source of truth, powerful search, and bulk exports compress timelines. -

Higher deal confidence

Consistent, up-to-date documents reduce ambiguity and perceived risk. -

Tighter access control

Role-based permissions, view-only, expiry links, and NDA gating maintain confidentiality. -

Better storytelling

Structured folders and clear narrative (why now, why us, use of proceeds) help investors get conviction. -

Actionable analytics

See which firms and partners are engaged (e.g., time spent in Financials vs. Product). Prioritize follow-ups intelligently. -

Lower legal/compliance risk

Watermarks, redaction, DRM, and activity logs support GDPR, SOC 2, ISO 27001, and sector-specific requirements.

Core Features to Look For (2025)

-

Security & Compliance: AES-256 encryption at rest, TLS 1.2+ in transit, MFA/SSO, device control, IP allowlists, granular permissions, dynamic watermarks, view-only with disabled print/download, document expiry, SOC 2 Type II, ISO 27001, GDPR tooling (DPIA support, data residency options).

-

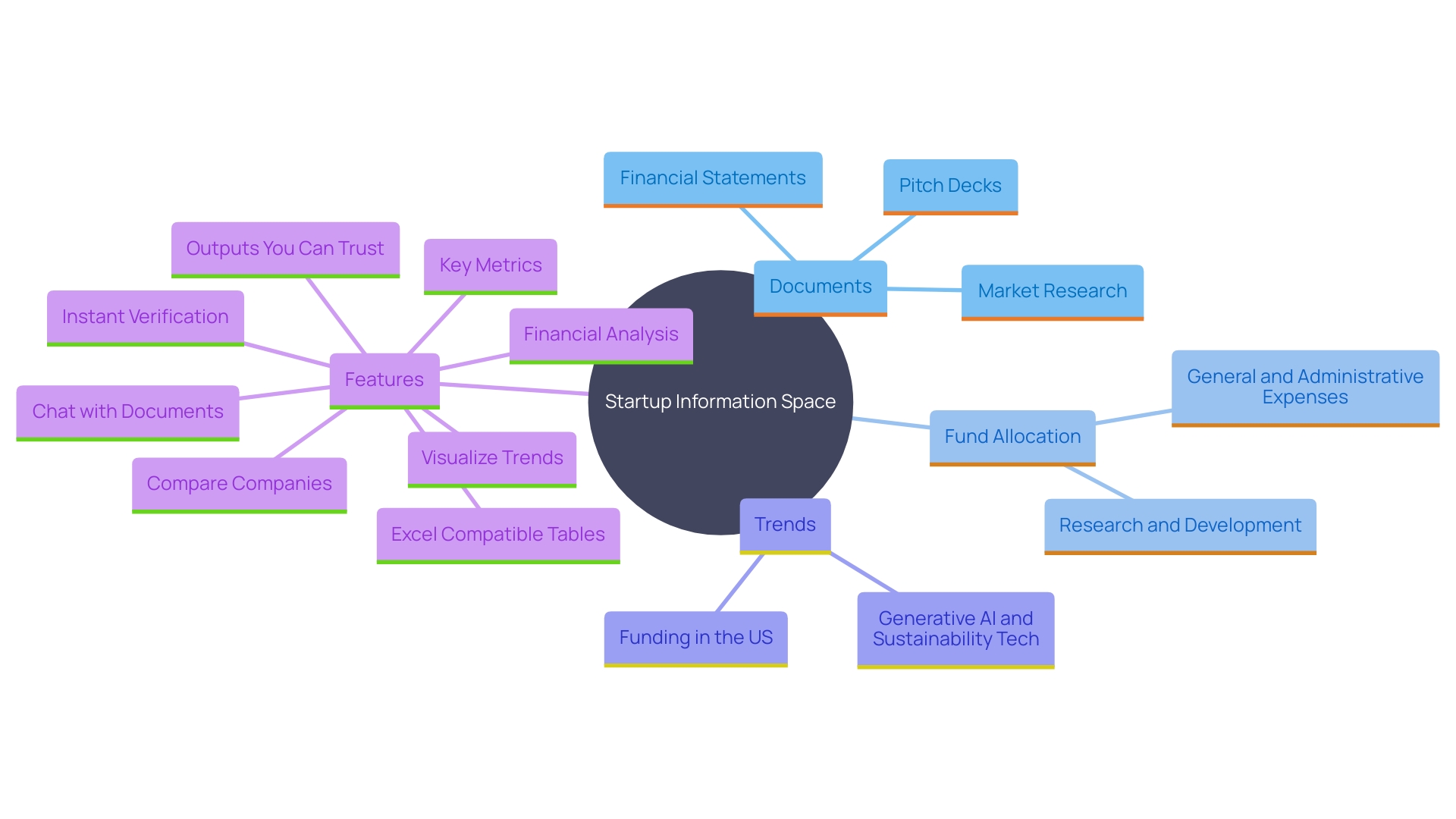

AI-Powered Search & Summaries: Semantic search across PDFs/Slides/Docs; AI summaries of long contracts or board minutes; automatic PII detection + redaction.

-

Document Management: Versioning, bulk upload, OCR, auto-indexing, cross-linking, and Q&A module to manage diligence questions.

-

Analytics: Heatmaps, per-user/session reports, investor scorecards, alerts on spikes in engagement.

-

Collaboration: Commenting, Q&A workflows, templated responses, assignable owners.

-

Ease of Use: Clean UI, folder templates, drag-and-drop, mobile access, audit exports.

-

Integrations: Google Drive, OneDrive, Box, Slack, Jira, Notion, e-sign (DocuSign), and SSO (Okta, Azure AD).

How to Create a Data Room for Investors (Step-by-Step)

-

Choose a VDR vendor

Prioritize security certifications, permission depth, analytics, and AI features. Ensure data residency options match your regulatory profile. -

Define the narrative

Before uploading, settle on your deal story: market, problem/solution, traction, defensibility, use of funds, roadmap, risks/mitigation. -

Assemble & sanitize documents

-

Ensure current, consistent versions (dates, units, ARR vs. revenue, etc.).

-

Redact sensitive customer PII or secrets not needed for initial passes.

-

Normalize naming:

YYYY-MM Filename vXfor auditability.

-

-

Build a logical folder structure (template below)

-

Set permissions & NDA gating

-

Create groups (e.g., Firm A – Partners, Associates).

-

Start view-only for sensitive folders; open up during confirmatory diligence.

-

Use link expiry and watermarks on exports.

-

-

Publish a Read-Me & change log

A 1-pager on where to find what, plus a What’s New doc for updates. -

Monitor engagement & iterate

Use analytics to prioritize outreach and pre-empt questions with Q&A or additional uploads.

What to Include: Investor Data Room Checklist

0) Start Here

-

Read-Me / Index

-

Narrative summary (1000–1500 words)

-

What’s New / Change Log

1) Corporate & Legal

-

Certificate of incorporation, bylaws, cap table, option plan, board minutes, shareholder agreements, IP assignments, key contracts (customer, vendor, cloud/SaaS), NDAs, litigation summary, regulatory/licensing docs (if applicable).

2) Financials

-

Historical financials (P&L, BS, CF; monthly for 24–36 months)

-

ARR / MRR bridges, revenue by cohort, gross margin by product

-

Forecast model (12–36 months) with assumptions tab

-

Use of proceeds (G&A, Platform R&D, Program-specific R&D, GTM)

-

Audit/review letters, tax filings (as applicable)

3) KPIs & Cohorts

-

Unit economics (CAC, LTV, payback, contribution margin)

-

Funnel conversion, retention/churn, NRR/GRR

-

Cohort tables (by signup month/segment/plan)

-

Pricing & packaging, discount policies

4) Product & Technology

-

Product roadmap, architecture diagrams, security overview (SOC 2/ISO 27001), data flow, privacy program, disaster recovery/BCP, uptime and incident history, third-party dependencies, QA/release process.

5) Market & Competition

-

TAM/SAM/SOM, segmentation, market size methodology

-

Competitive matrix, differentiators, moat/defensibility

-

Analyst reports, case studies, win/loss analysis

6) Commercial

-

Top customers (logos where permitted), pipeline summary, master agreements/SOWs, churn reasons, NPS/CSAT, renewals calendar.

7) People & Hiring

-

Org chart, founder bios, key exec resumes, ESOP policy, hiring plan, compensation philosophy, diversity metrics (optional).

8) Governance & Risk

-

Board composition, policies, compliance register, risk register with mitigations, insurance (D&O, cyber, E&O).

9) Diligence Q&A

-

Centralized tracker, assigned owners, SLA for responses.

Data Room Best Practices (That Actually Move Deals)

-

Keep it current: Date-stamp files and maintain a visible change log.

-

Stage access: Start with essentials; unlock sensitive items (e.g., customer contracts) in confirmatory diligence.

-

Use AI wisely: Summaries speed reading; do not replace source docs.

-

Prevent leakage: Dynamic watermarks + view-only + link expiry on sensitive files.

-

Centralize Q&A: One official thread with searchable answers.

-

Consistency over volume: A clean, consistent set beats a bloated, messy archive.

-

Tell a story with metrics: Tie KPIs to the plan and use of proceeds.

-

Audit everything: Export audit logs for your counsel and IC.

Security Measures for Investor Data Rooms

-

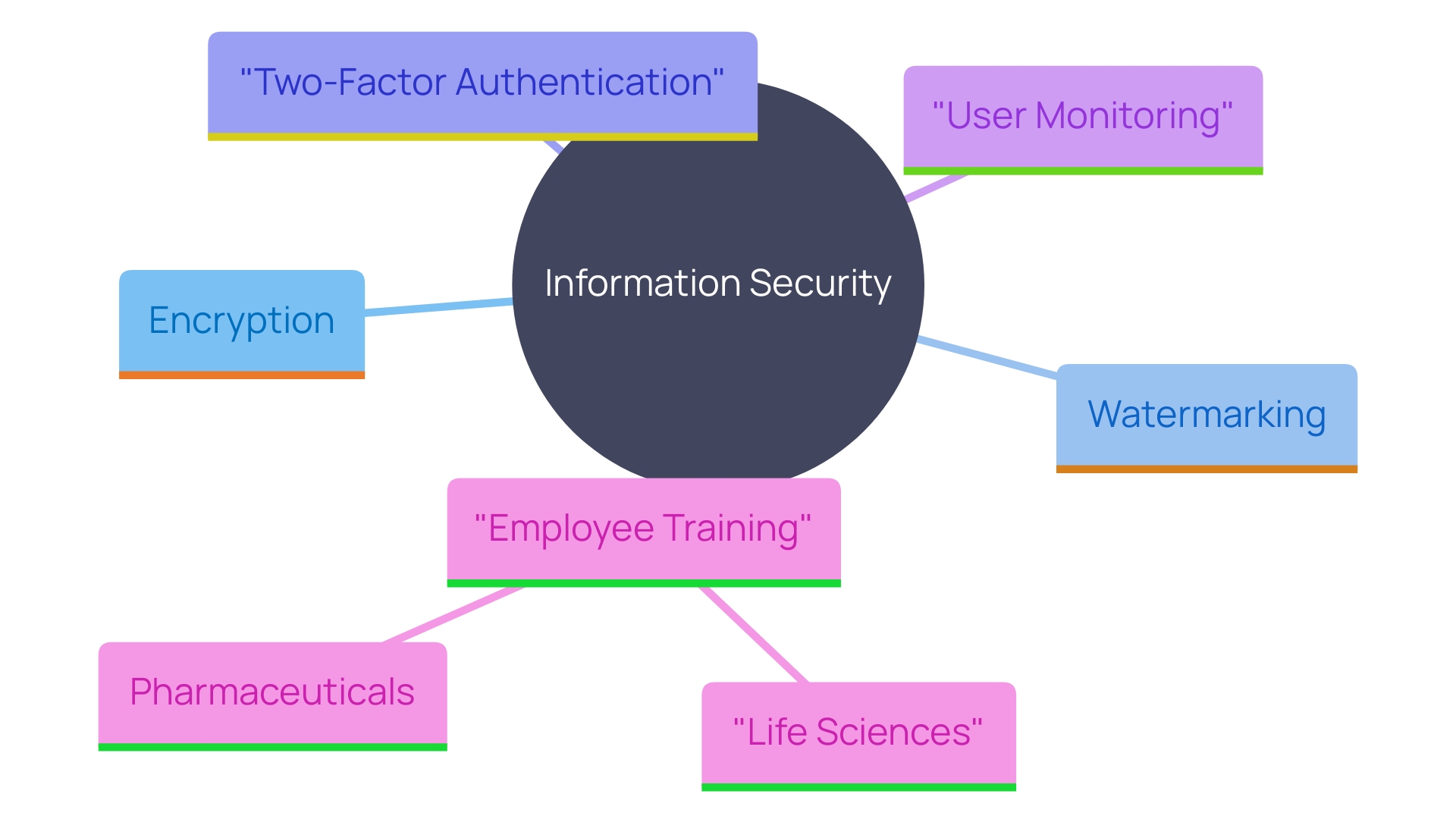

Encryption: AES-256 at rest; TLS 1.2+ in transit

-

Identity: SSO/SAML, MFA, device checks, IP allowlists

-

Permissions: Folder/file-level rights, view-only, disable print/download

-

Content Protection: Dynamic watermarking, DRM, auto-redaction of PII

-

Monitoring: Real-time alerts, session logs, anomaly detection

-

Resilience: Backups, geo-redundancy, RTO/RPO targets, tested DR plans

-

Compliance: SOC 2 Type II, ISO 27001, GDPR tooling (DPA, SCCs, data residency)

For regulated verticals (healthcare, fintech, life sciences), verify sector-specific controls (e.g., HIPAA, PCI DSS, GxP).

Common Use Cases (Fundraising & Beyond)

-

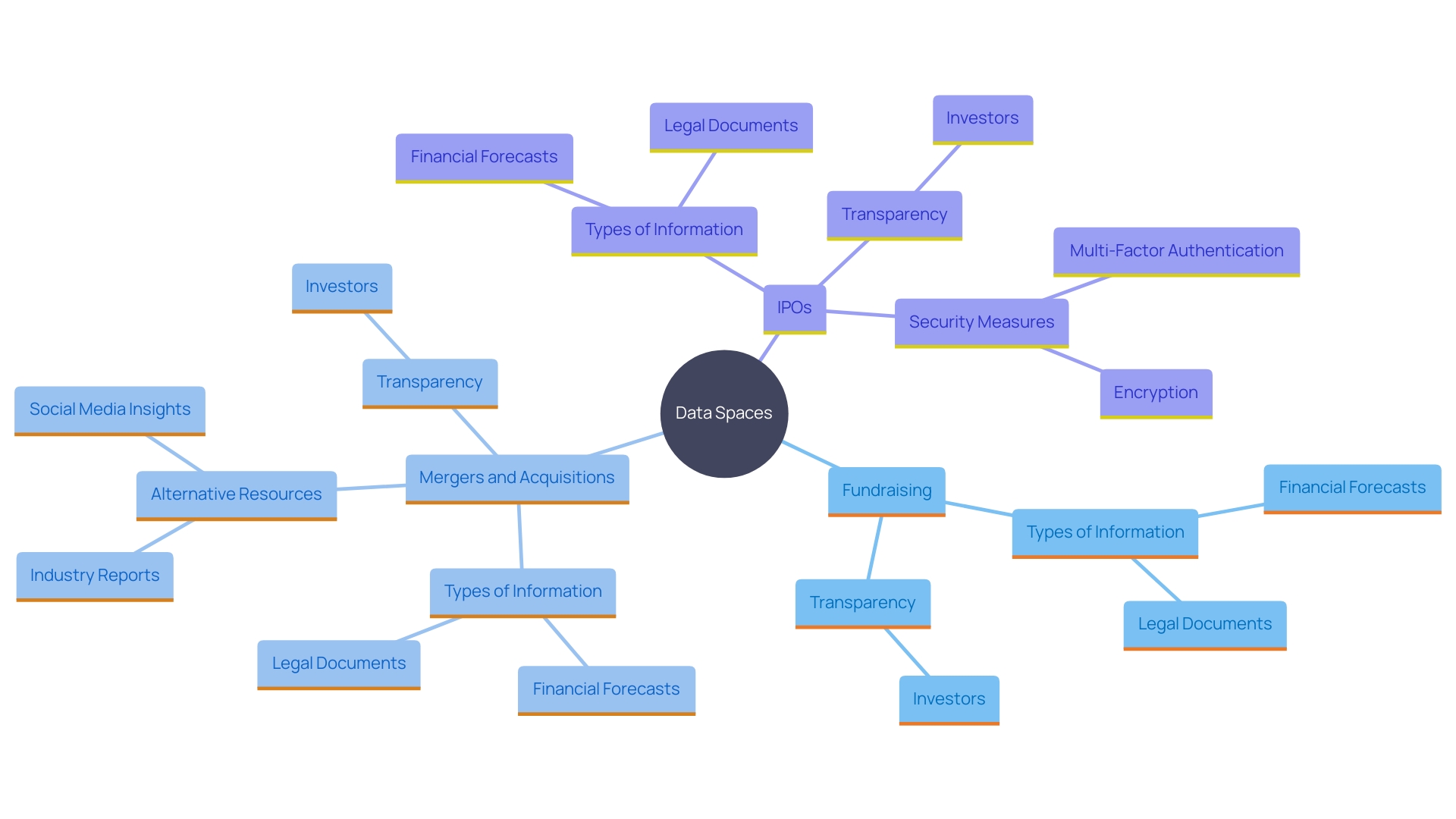

Seed/Series A–D fundraising (pre-term-sheet teaser set → full diligence)

-

M&A (sell-side and buy-side rooms; clean-team access)

-

Secondaries (cap-table transparency, rights management)

-

Debt financing (lender packages, covenants, audit trails)

-

IPO readiness (SOX prep, disclosure controls)

-

Partner/Channel diligence (limited scopes)

How to Choose the Right Data Room Provider

Score vendors on:

-

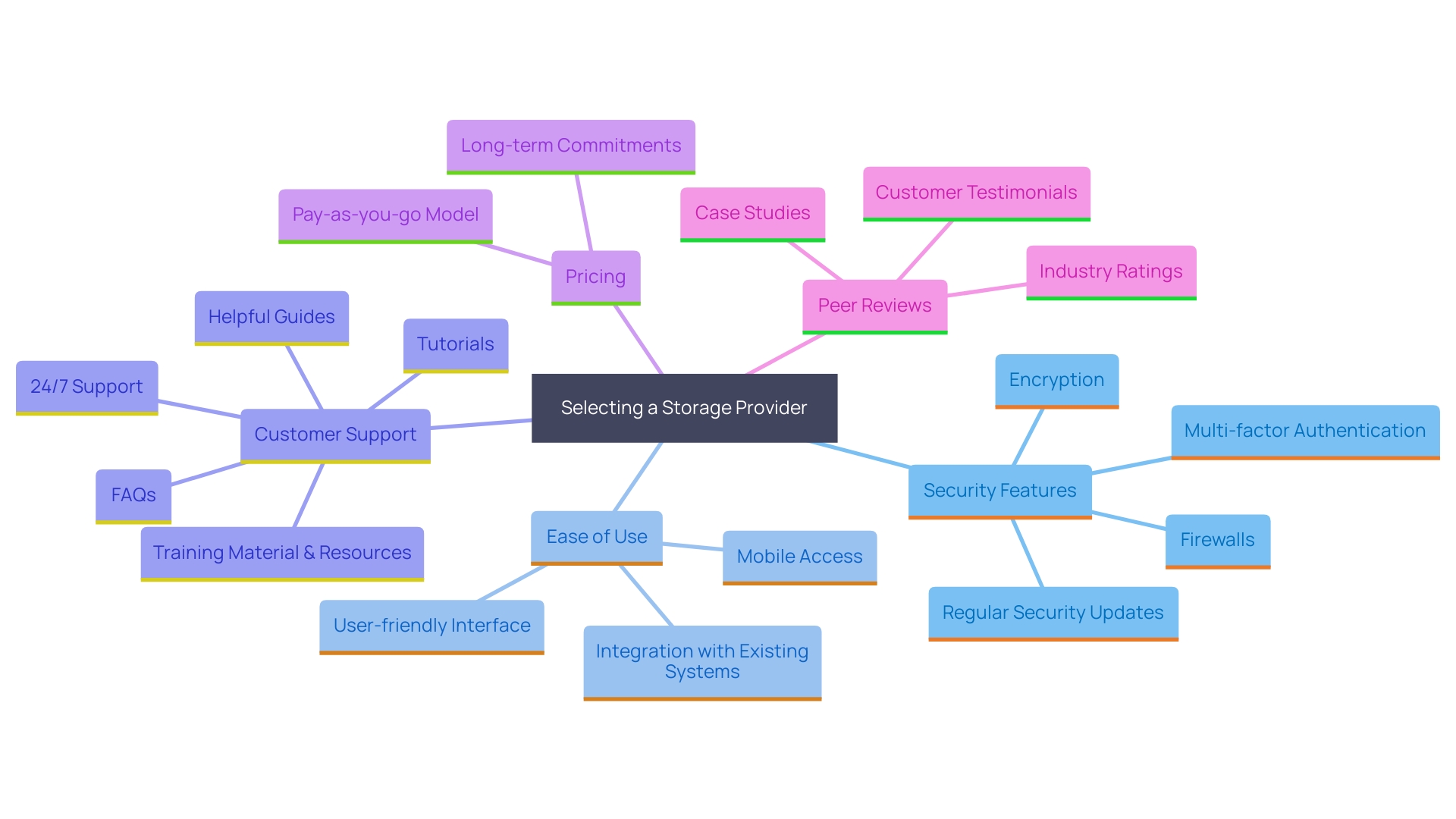

Security & Certifications (SOC 2 Type II, ISO 27001, data residency)

-

Access Control Depth (group vs. user, DRM, expiry, watermarking)

-

AI & Search (semantic search, summaries, PII detection/redaction)

-

Analytics (per-doc/user heatmaps, alerts, exports)

-

Usability (setup time, templates, support, training)

-

Integrations (Drive/OneDrive/Box, Slack, e-sign, SSO)

-

Support & SLAs (24/7, dedicated CSM, migration help)

-

Pricing & Scale (rooms, users, storage, overage fees)

Pro tip: Run a 2-week pilot with sanitized content to test upload speed, search quality, permissioning friction, and analytics—then lock terms.

Metrics to Track (Prove the Data Room’s ROI)

-

Time to close (data room launch → signed term sheet)

-

Investor engagement (unique viewers, sessions, time per folder)

-

Q&A velocity (median time to answer, reopened questions)

-

Revision churn (version count on key docs)

-

Leakage incidents (should be zero; confirm controls worked)

FAQs

What is an investor data room?

A secure online repository where startups share confidential documents with investors during fundraising and diligence.

Is Google Drive enough for diligence?

It can work early, but VDRs add DRM, watermarks, detailed analytics, granular permissions, and audit logs that investors and lawyers expect.

When should I open my data room?

Create a light version before first meetings; expand to full confirmatory diligence post-term-sheet.

What should I exclude initially?

Customer-identifiable contracts, deep IP detail, and sensitive PII. Provide summaries first; unlock specifics later with stricter controls.

Who manages the data room?

Typically the CFO/Head of Finance with Legal/Ops; assign owners for Q&A and a weekly hygiene pass.

Conclusion

A modern, well-structured investor data room is the fastest path to cleaner diligence, faster decisions, and stronger investor trust. With cloud-native, AI-assisted VDRs, you can safeguard sensitive information, tell a sharper story with data, and shorten your fundraising timeline—all while staying compliant.

Adopt the folder structure and checklist above, enforce security best practices, and choose a provider that matches your risk profile, workflows, and scale. Done right, your data room becomes a competitive advantage—not just a filing cabinet.