Understanding Net Burn Rate: Key Metrics for Financial Health

Introduction

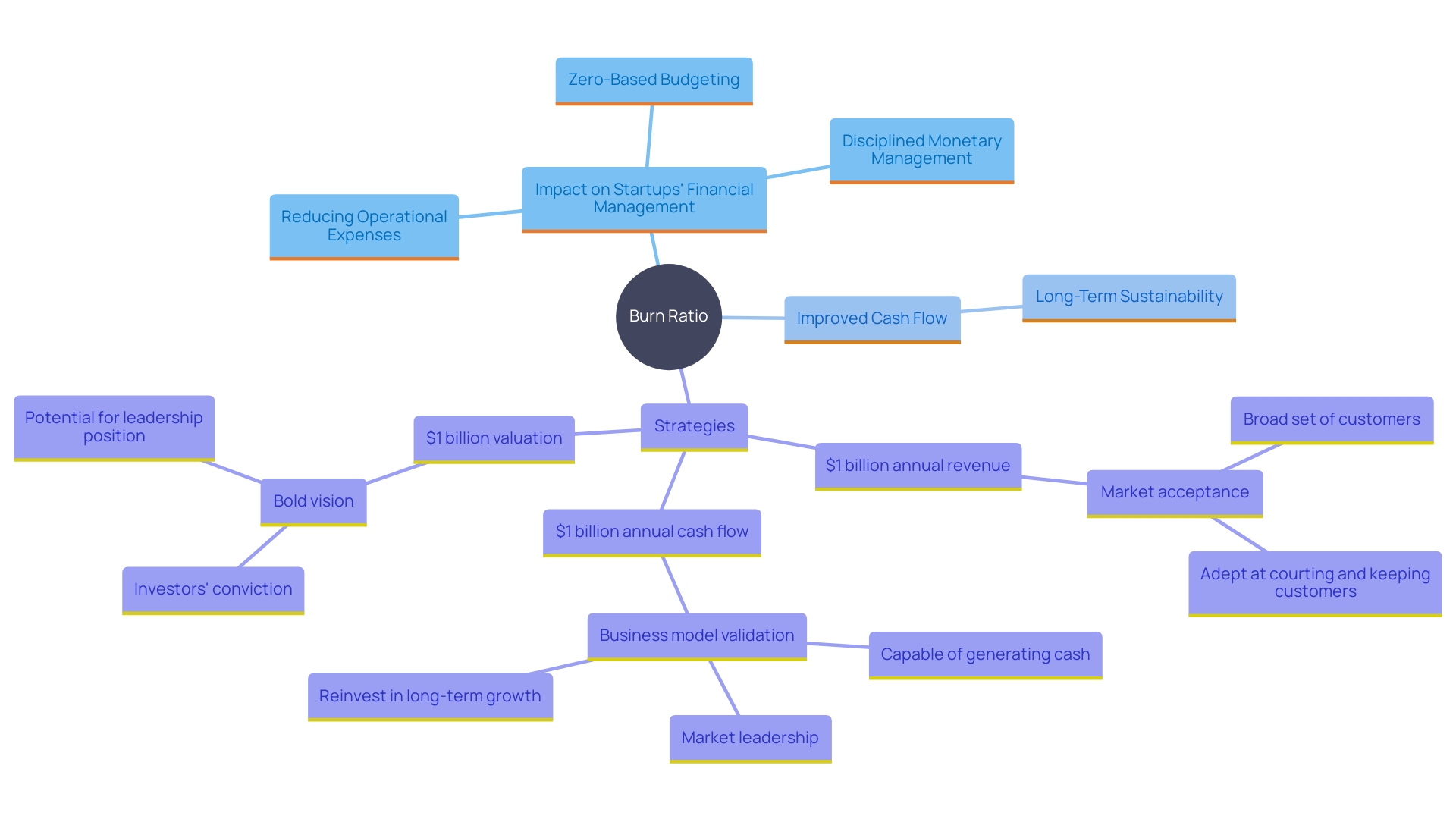

In today’s fast-moving startup ecosystem, managing burn rate is one of the most critical factors for sustainable growth and survival. Burn rate measures how quickly a company spends its available cash, directly influencing runway, fundraising cycles, and investor confidence. For founders, understanding and optimizing burn rate is not just an accounting task—it’s a core strategy for long-term success.

This guide explores what burn rate means, the difference between gross and net burn rate, and actionable strategies to control both. Drawing from real-world examples like Etsy and Monday.com, we’ll uncover how disciplined financial management, operational efficiency, and smart budgeting can extend cash runway, boost free cash flow, and improve profitability. By mastering burn rate, startups can secure investor trust and position themselves for sustainable success in a competitive market.

What is Burn Rate?

Burn rate is a key startup financial metric that shows how fast a company is consuming its cash reserves, especially during early growth. It reflects the pace at which operating expenses drain capital before profitability is achieved. Monitoring burn rate helps startups align expenses with funding cycles and optimize resource allocation.

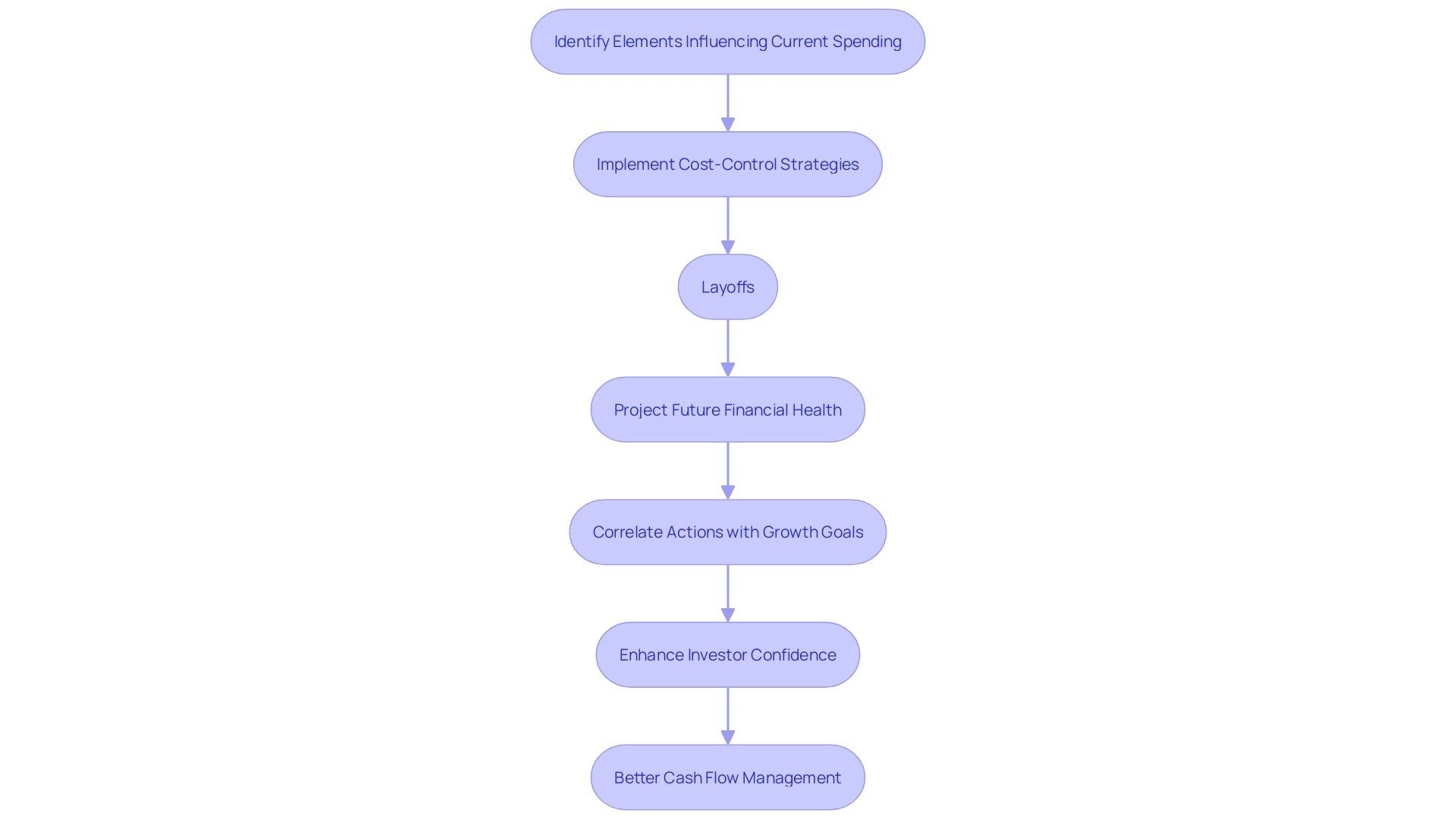

In 2023, many startups reduced burn rate by aggressively cutting operating expenses (OpEx), which extended the median cash runway to 12.5 months (up from the typical 9–10 months). While difficult choices such as layoffs contributed to this, they also revealed a broader trend toward leaner, more efficient operations.

At Etsy, for example, former CTO Mike Fisher highlighted the role of data-driven financial discipline. By testing new features through internal platforms and tracking user behavior, Etsy optimized resource allocation while maintaining customer focus—ensuring smarter capital deployment.

Healy Jones, VP of Financial Strategy at Kruze Consulting, confirmed this trend, noting that lowered OpEx has reduced the average burn across startups. Techniques like zero-based budgeting—rebuilding budgets from scratch annually—are helping founders ensure that every expense directly supports growth and profitability.

Ultimately, managing burn rate is not just survival—it’s about laying the financial foundation for scalable, long-term growth.

Gross Burn Rate vs. Net Burn Rate

Understanding the difference between gross burn rate and net burn rate is essential:

-

Gross burn rate = Total monthly cash outflows (salaries, rent, marketing, etc.)

-

Net burn rate = Gross burn rate minus monthly revenue (actual cash lost per month)

This distinction helps investors and founders gauge operational efficiency and revenue strength.

Take Monday.com as an example. Despite rapid growth, the company maintained efficiency in R&D and sales & marketing, driving high free cash flow margins. Many startups that cut monthly burn by 30% last year did so by tightening marketing budgets—proving that growth and efficiency can coexist.

Reducing burn rate doesn’t always mean cutting costs. It also means strategically investing in areas with the highest return. Founders who master gross vs. net burn rate ensure sustainable scaling while preparing for fundraising and profitability milestones.

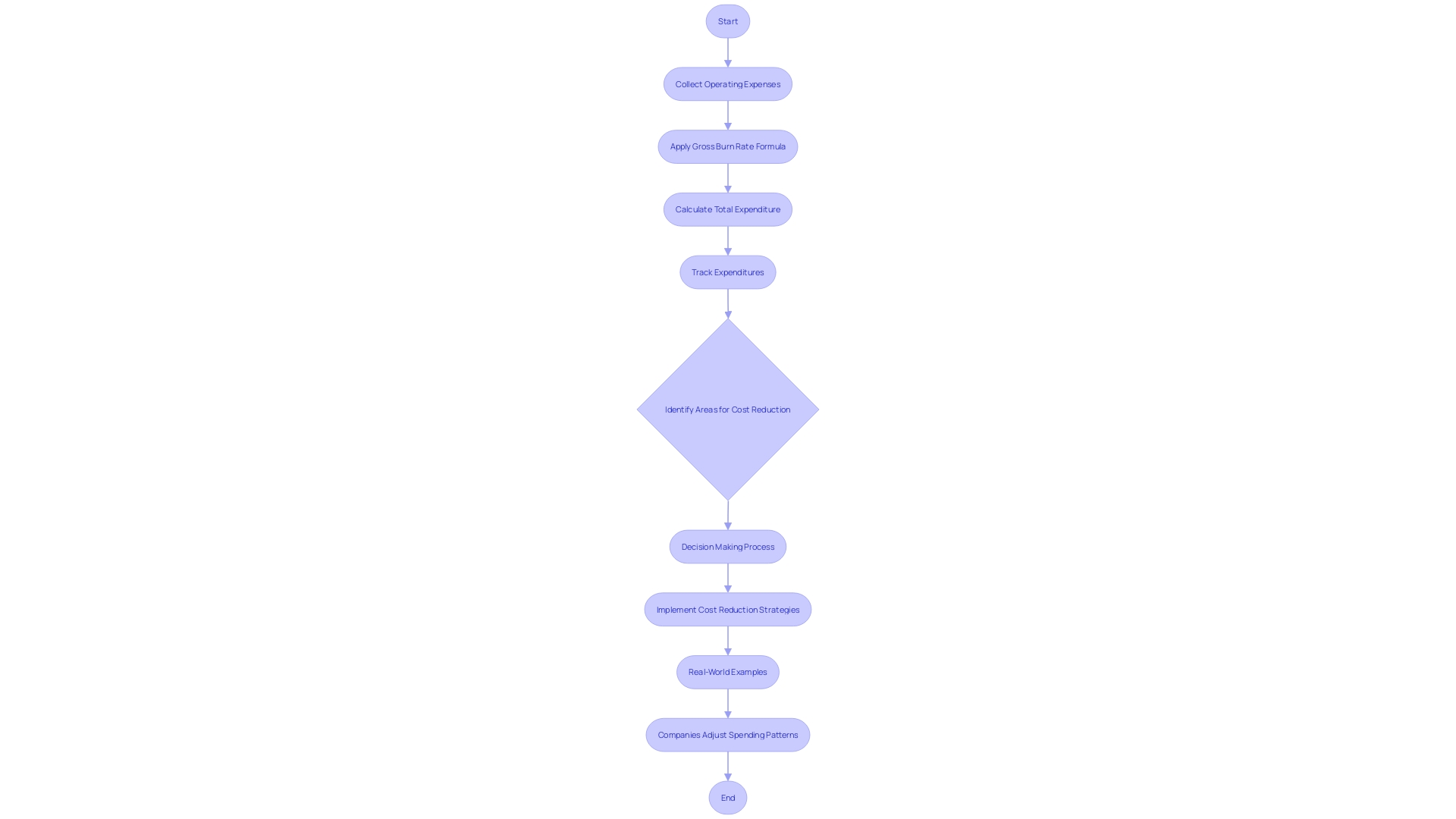

How to Calculate Gross Burn Rate

The formula is straightforward:

Gross Burn Rate = Total Monthly Cash Outflows ÷ Time Period

Cash outflows include payroll, rent, SaaS subscriptions, infrastructure, and other operating costs. Tracking this monthly helps startups identify overspending and cost spikes.

For instance, one startup noticed a 20% cost increase linked to Amazon Savings Plan rebalancing. By analyzing detailed reports, they traced the source and corrected it—demonstrating the importance of granular financial monitoring.

Recent surveys show two-thirds of founders cut monthly expenses in 2023, often reducing marketing and non-core costs. This reflects a shift toward financial discipline that ensures survival in competitive environments where cash efficiency equals resilience.

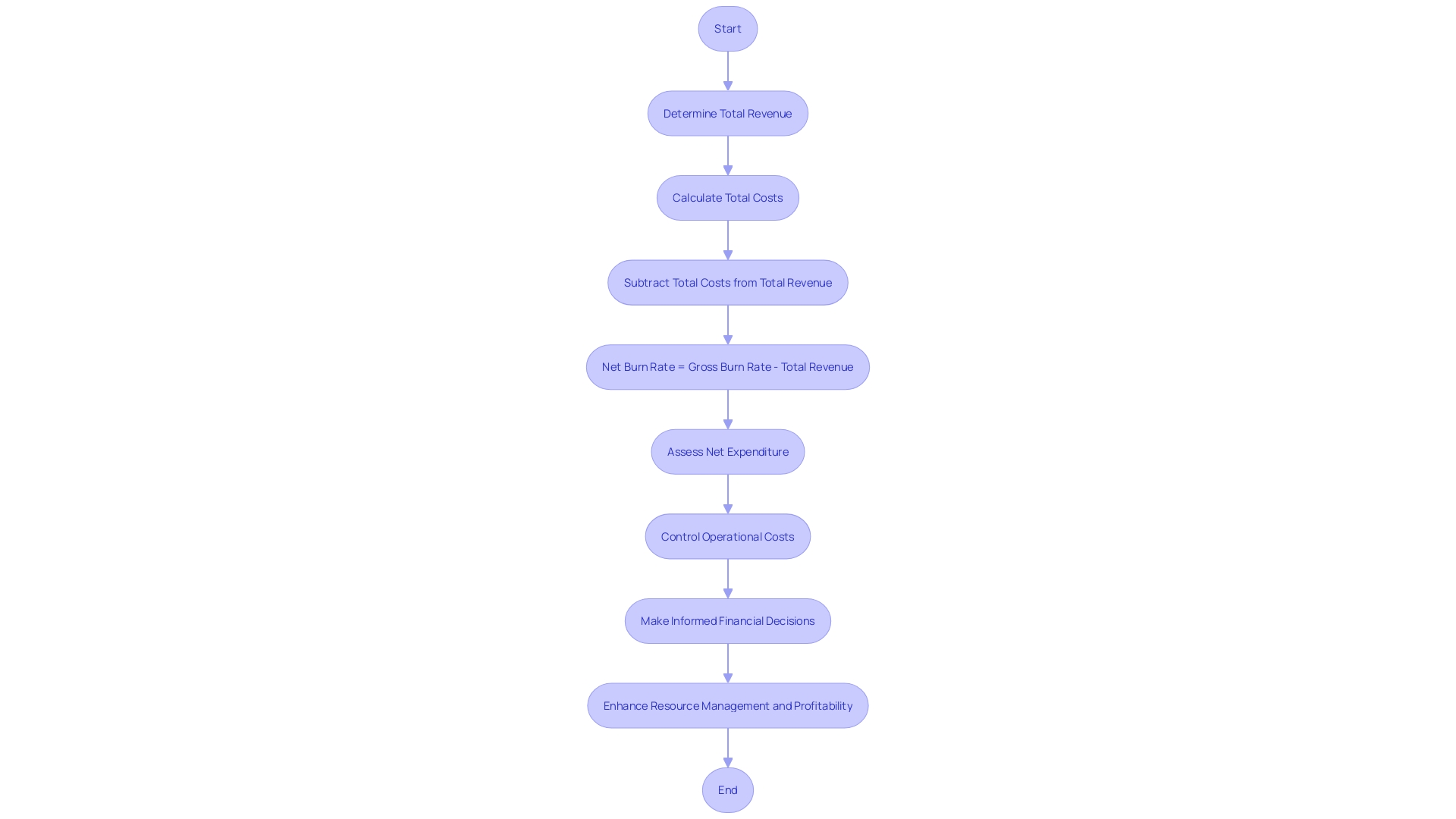

How to Calculate Net Burn Rate

Net burn rate shows actual monthly cash loss after accounting for revenue:

Net Burn Rate = Gross Burn Rate – Monthly Revenue

This metric reveals how much runway remains and when startups need to raise capital.

Kruze Consulting reports that many startups are benefiting from reduced OpEx and higher revenue efficiency, lowering their net burn despite macroeconomic uncertainty. Companies like Monday.com prove that strategic R&D and sales execution can boost free cash flow and long-term profitability—even with modest valuations compared to peers.

Startups that accurately calculate and control net burn gain flexibility to adapt to market shifts, attract investors, and maintain resilience during downturns.

Understanding Your Cash Runway

Cash runway = Total available cash ÷ Net Burn Rate

This reveals how long a startup can operate before funds run out. Extending runway gives founders more time to hit milestones and raise capital on favorable terms.

In late 2023, median startup runway increased to 12.5 months, up from the standard 9–10 months—driven by leaner OpEx and smarter cash management. However, experts like Tal Brener (CFO, Zego) caution that anything below 12 months of runway is a “death zone.”

Companies valued at $1B+ often succeed by mastering runway management and reinvesting wisely in growth. Even simple tactics—such as placing excess funds in safe deposit accounts—can yield interest income that extends runway further.

For startups, managing runway isn’t just survival—it’s the difference between stalling out and scaling successfully.

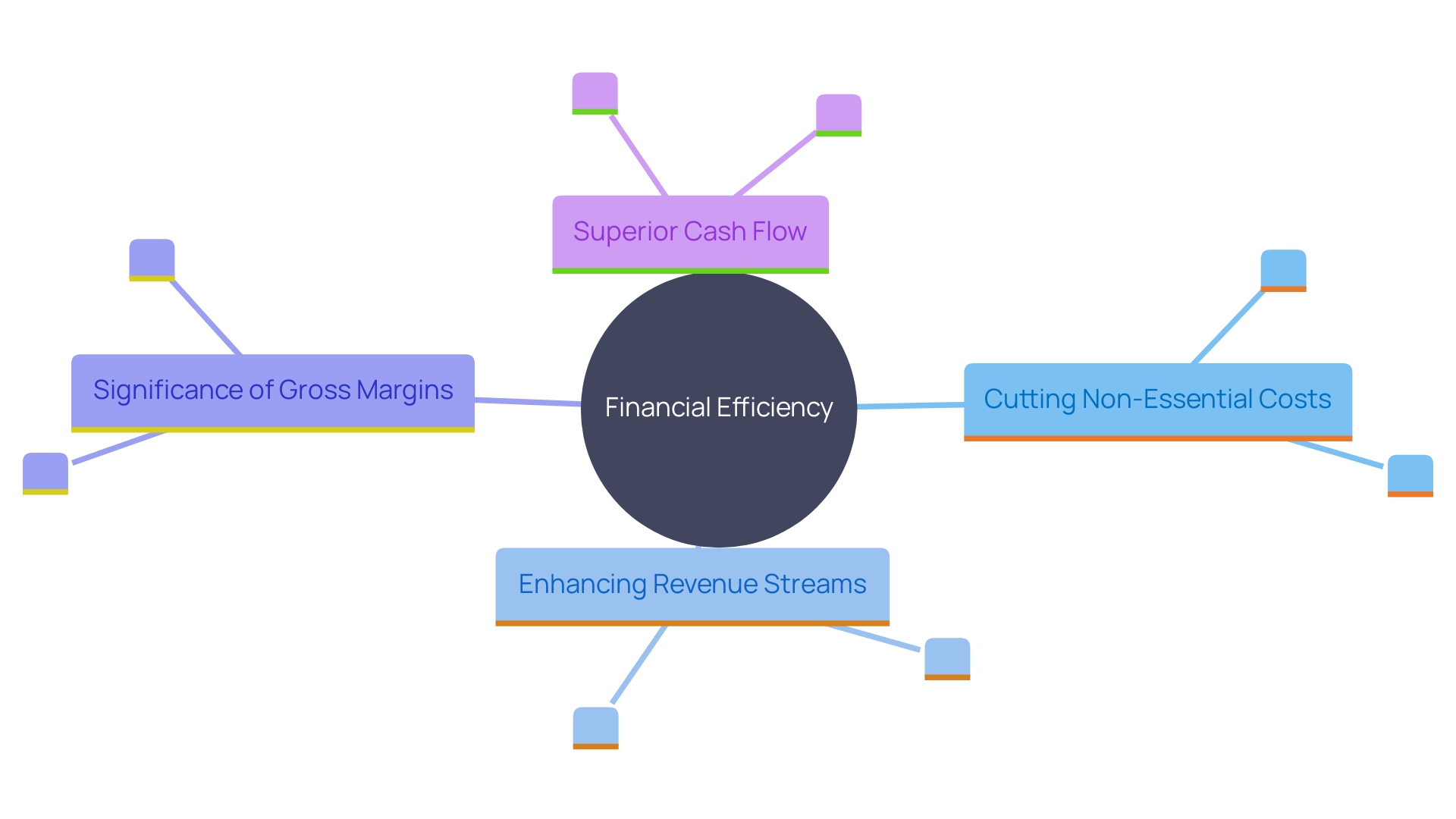

Managing Your Net Burn Rate

To control net burn rate, founders must balance cost reduction with revenue growth.

-

Regularly review spending to eliminate non-essential expenses.

-

Improve sales efficiency, as Monday.com did by optimizing its sales and marketing ROI.

-

Enhance customer lifetime value (LTV) through retention strategies.

-

Diversify revenue streams for stability during downturns.

Kruze Consulting notes that startups with disciplined expense planning are extending their runways and boosting investor appeal. Companies with high gross margins typically achieve stronger free cash flow—underlining the value of operational efficiency plus revenue optimization.

Strategies to Reduce Net Burn Rate

Practical strategies include:

-

Renegotiate supplier contracts and reduce overheads.

-

Streamline operations using automation and analytics.

-

Diversify revenue streams through new markets or product lines.

-

Strengthen customer retention via loyalty programs and personalization.

-

Leverage technology to cut costs without sacrificing quality.

Startups that adopt these measures not only survive but also increase their attractiveness to investors. By embedding efficiency into culture, businesses can transform burn rate reduction into a competitive advantage.

Communicating Burn Rate to Investors

Transparency is vital when discussing burn rate with investors. Provide:

-

A breakdown of gross and net burn rates

-

Current cash runway projections

-

Clear plans for cost management and revenue growth

Healy Jones of Kruze Consulting emphasizes that founders who proactively explain how they’re controlling OpEx and extending runway build trust. Monday.com’s example proves that effective expense management translates into strong free cash flow—making startups far more appealing to investors.

Conclusion

Mastering burn rate is non-negotiable for startup success. By understanding the difference between gross and net burn, calculating them accurately, and applying cost-control strategies, founders can optimize cash flow, extend runway, and build investor confidence.

Case studies from Etsy and Monday.com prove that disciplined financial management and innovative budgeting help startups not just survive downturns but emerge stronger. The trend toward extended cash runways shows that efficiency is becoming a defining trait of successful startups.

For founders, the path forward is clear: embrace efficiency, practice financial discipline, and communicate transparently with investors. With the right burn rate strategy, startups can transform financial pressure into a springboard for sustainable growth and profitability.

Ready to optimize your startup’s burn rate? Contact us today to explore tailored strategies for sustainable scaling.