Understanding Cash Burn Meaning: Key Insights and Financial Implications

Introduction

In today’s fast-paced business landscape, understanding and managing cash burn rate can mean the difference between success and failure. For Chief Marketing Officers (CMOs) navigating the complexities of startup growth, this crucial metric offers deep insights into financial health and operational efficiency. As economic conditions fluctuate and venture capital becomes less accessible, mastering cash burn rate becomes ever more essential.

This article delves into the nuances of cash burn rate, exploring its significance, how to calculate it, and strategies for effective management. Discover how to strike the perfect balance between growth and sustainability, ensuring your company thrives in even the most challenging environments.

What is Cash Burn Rate?

The rate of expenditure is an essential measure that assesses how rapidly a company exhausts its financial reserves to manage operational expenses prior to attaining positive financial flow. For startups and growth-stage companies, understanding and managing this rate is crucial to sustaining operations and avoiding economic pitfalls. As Jason Mok from Brex emphasizes, effective cash management strategies and capital preservation are vital, especially in unpredictable economic climates.

Startups often face a harsh reality, with about two-thirds failing to generate positive returns for investors, as noted by the Harvard Business Review. This highlights the significance of careful budgeting and strategic foresight. Eric Kraft, a commercial banking executive, advises businesses to conduct annual strategic planning sessions that encompass financial projections and multiple economic scenarios. This proactive approach enables companies to navigate economic fluctuations more effectively.

In the present market conditions, where interest rates are elevated and venture capital financing is harder to obtain, startups must be especially cautious about their expenditure rates. Healy Jones from Kruze Consulting highlights that although layoffs have led to reduced operational costs, they have also encouraged founders to be more effective in their financial use. This focus on efficiency has extended the median startup runway to 12.5 months, a significant increase from the usual nine to ten months.

Ultimately, effectively handling financial depletion can determine the distinction between flourishing and just existing. By aligning monetary strategies with operational realities and maintaining a disciplined approach to spending, businesses can ensure they are well-prepared for both opportunities and challenges ahead.

Types of Burn Rates: Gross Burn vs. Net Burn

‘Gross expenditure refers to the total outflow of funds within a specific period, not considering any incoming revenue. This metric is crucial for understanding the raw monetary demands of a business. Conversely, net depletion gives a more detailed perspective by deducting the cash inflow from the total expenditure, presenting a clearer assessment of the company’s economic wellbeing.

In today’s unpredictable market, where venture funding is becoming increasingly scarce, maintaining a disciplined approach to expenditure rates is essential. As Healy Jones, VP of financial strategy at Kruze Consulting, observes, ‘The average expenditure is decreasing this year, driven by lower OpEx spending.’. This is founders focusing on being more efficient.” This shift towards efficiency is not without its challenges, as evidenced by the layoffs making headlines, yet it underscores the importance of effective resource management.

The decrease in consumption rates is also evident in the median startup runway, which has risen to 12.5 months in the second half of 2023, up from the typical nine to ten months. This longer runway allows companies more time to strategize and pivot as needed. However, it’s worth noting that the ability to adhere to an expenditure rate budget can be the difference between survival and failure, especially in a higher churn environment.

This year has observed a decline in combustion rates, primarily due to reduced operational expenditures (OpEx). This trend indicates that founders are learning to manage their resources more effectively, a necessary adaptation in a competitive landscape. The expanding difference between operational expenses and expenditure rates indicates that firms are increasingly concentrating on producing profitable income, a notable enhancement from previous years.

In the end, comprehending and handling both total and net expenditure rates are essential for navigating the economic intricacies of today’s market. These metrics not only reflect an organization’s current financial health but also its ability to sustain and grow in the long term.

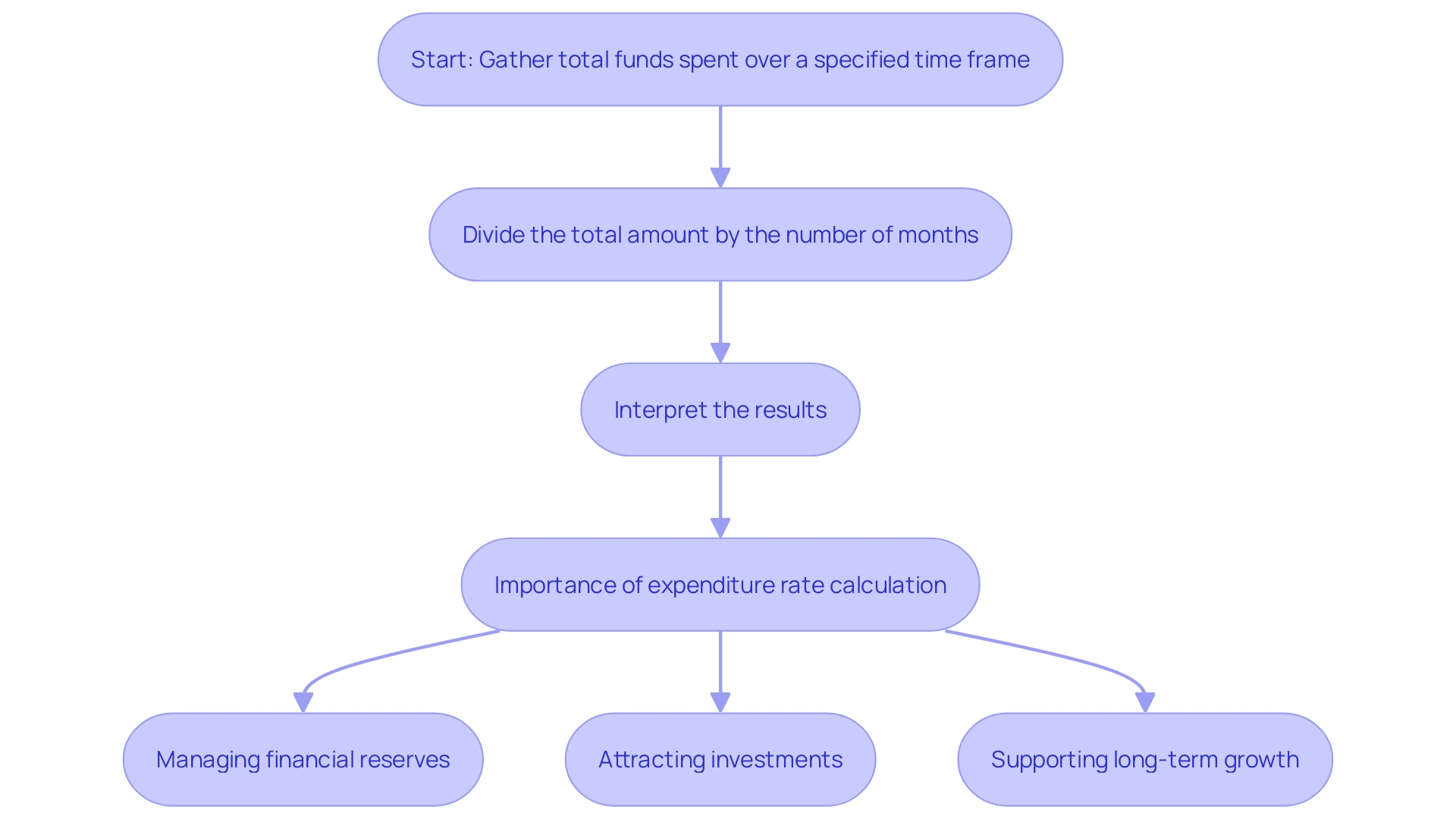

How to Calculate Cash Burn Rate

To precisely calculate your organization’s expenditure rate, divide the total funds spent over a specific time frame, usually a month, by the number of months in that duration. This straightforward calculation provides a transparent view of how swiftly your business is depleting its financial reserves. For example, software firms such as Monday.com uphold a strict method for tracking their financial outflow, making sure they do not surpass budgeted spending even in high turnover settings. This alertness is essential, as it enables businesses to produce surplus funds, a vital factor in long-term stockholder worth. Recent trends indicate that late-stage startups with a clear path to IPOs are attracting significant investment, highlighting the importance of a managed expenditure rate in achieving financial milestones. Effective financial management not only prolongs the liquidity runway but also enables businesses to capitalize on growth opportunities, increasing their attractiveness to investors.

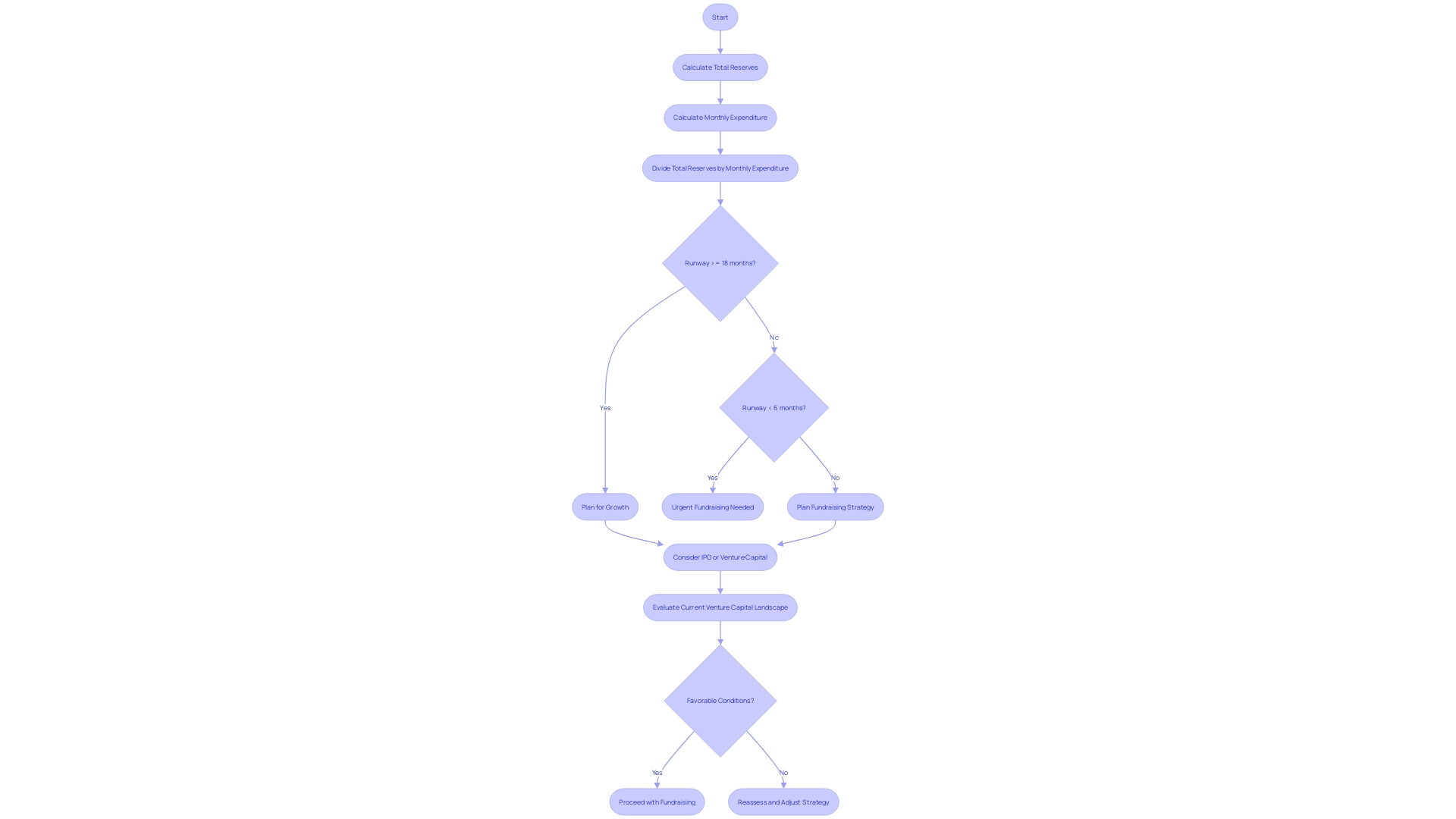

Understanding Cash Runway

Financial runway indicates the duration a company can maintain its activities before depleting its monetary reserves, depending on its existing expenditure rate. Determining the financial runway involves dividing the total reserves by the monthly expenditure rate, providing an essential timeframe for strategic planning. Alarmingly, Pilot.com’s data reveals that 57% of venture-backed startups have less than 18 months of runway left. Given that fundraising typically requires a six-month runway buffer, many startups will need to secure additional funding by mid-2024. However, the venture capital landscape has dramatically shifted, with investments slowing down, placing startup founders in a precarious position. This situation highlights the significance of strong resource management practices to extend runway and ensure long-term sustainability. ‘For example, efficient fund management strategies, like those emphasized by Jason Mok of Brex, focus on capital preservation and alignment with investors, which are crucial for navigating economic uncertainties.’. Moreover, the capability to operate autonomously without ongoing venture capital infusions, as demonstrated by a small number of successful unicorns, is a testament to solid economic planning and strategic foresight.

Why is Cash Burn Rate Important?

Tracking the expenditure rate is essential for preserving financial viability and guaranteeing lasting success. By monitoring expenses closely, companies can gain insights into their spending habits, identify potential liquidity issues, and make informed choices regarding fundraising, budgeting, and expanding operations. For instance, Snowflake’s rise in free funds flow margins from 12% to 29% illustrates the effect of efficient financial management and cost control. In today’s competitive environment, where fundraising is becoming more difficult, having a strong understanding of financial position and projections is essential. As Jason Mok from Brex suggests, aligning with your board and investors on your financial management strategy is vital, especially for early-stage companies. The recent trend of startups struggling with shorter runways highlights the importance of proactive monetary planning. Efficient liquidity management not only assists in comprehending present monetary positions but also in predicting upcoming requirements, thus facilitating sustainable development. The recent surge in startup IPOs and funding in India further underscores the significance of robust cash management practices. By adopting these strategies, businesses can navigate financial uncertainties and demonstrate to stakeholders their commitment to long-term viability.

![]()

Factors Affecting Burn Rate

Several factors can influence a company’s expenditure rate, including operational efficiency, market conditions, business model, and growth strategies. In recent years, many startups have shifted their focus towards sustainable operations, emphasizing customer retention and upselling over the previous ‘growth at any cost’ mentality. This strategic shift has led to a noticeable reduction in expenditure rates, primarily driven by lower operational expenses (OpEx) and increased efficiency.

In 2023, we witnessed a significant improvement in growth, driven by reduced churn and a stronger focus on expanding the existing customer base. Forecasts for 2024 suggest continued growth, but within managed expectations, indicating a more cautious and calculated approach. Interestingly, the contribution of new customer acquisition to overall growth has decreased, with existing customer expansion playing a more significant role. This trend is expected to continue, underscoring the importance of customer retention and upselling in achieving sustainable growth.

Operational efficiency remains a critical factor in managing expenditure rates. ‘As Healy Jones, VP of monetary strategy at Kruze Consulting, observed, ‘The typical expenditure is decreasing this year, driven by reduced OpEx spending.’. This is founders focusing on being more efficient.’ This efficiency has not come without its challenges, as layoffs have been a contributing factor to reduced OpEx. However, it also highlights the founders’ ability to use their resources more effectively, a vital skill in today’s competitive environment.

Furthermore, the median startup runway has increased to 12.5 months in the second half of 2023, up from the typical nine to ten months following an average funding round. This extended runway is a positive indication that businesses are learning to manage their finances more prudently, ensuring they have sufficient cash reserves to navigate uncertain market conditions.

In summary, grasping and overseeing the elements affecting expenditure rate is vital for sustaining an organization’s economic well-being. By focusing on operational efficiency, adapting to market conditions, refining business models, and implementing strategic growth initiatives, companies can achieve sustainable growth and long-term success.

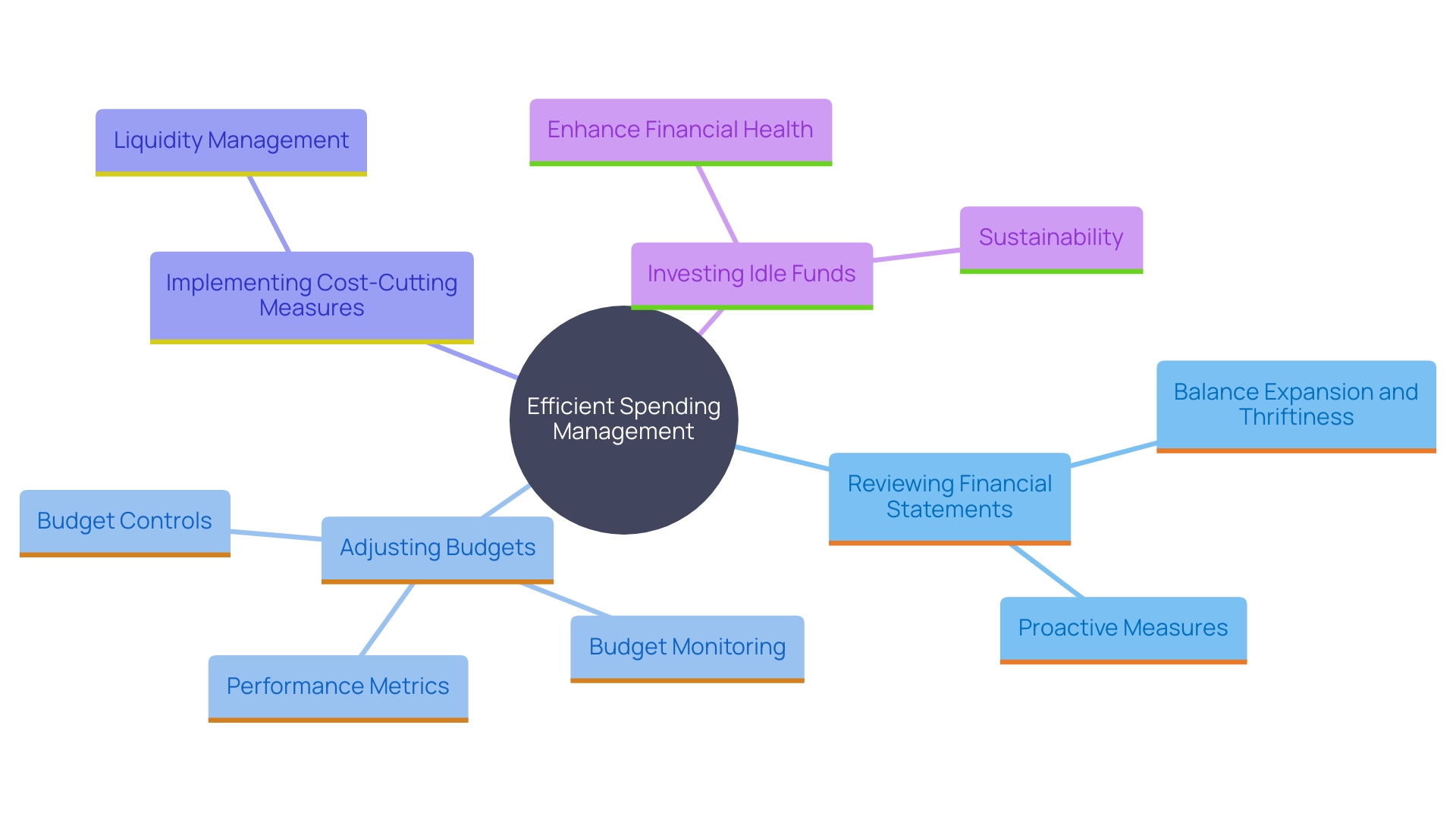

Managing and Balancing Cash Burn Rate

Efficient management of spending involves a multifaceted approach that includes regularly reviewing financial statements, adjusting budgets, and implementing cost-cutting measures when necessary. Finding the proper equilibrium between expansion and thriftiness is essential for sustaining a healthy flow of funds. In a competitive environment where fundraising is increasingly challenging, being proactive about your financial position and projections is key to achieving long-term goals.

One effective strategy is to consider investing any funds that are not needed in the near term into remunerated risk-free deposit accounts. This can provide a return of up to 5% per year, depending on the macroeconomic environment. For example, an organization that secures a €2.5 million round and expects to spend €1 million in the first year could potentially earn €30,000 in interest income by investing the remaining amount at a 3% net return. Although this may seem modest, it can significantly extend the organization’s runway and foster a culture of active cash management.

Furthermore, synchronizing new employee trial periods with reporting periods can be more cash-efficient. This method enables organizations to make more informed choices regarding moving staff to full-time positions, based on improved performance information linked to economic outcomes.

Grasping liquidity movement is not merely about monitoring funds entering and exiting; it includes the overall circulation of currency within an organization. Efficient liquidity management allows companies to expand sustainably, enhance economic stability, and stay adaptable enough to take advantage of new opportunities. According to a McKinsey report, 80% of value generation by successful growth firms comes from unlocking new revenues from existing customers, highlighting the importance of managing cash flow proactively.

By implementing simple processes and maintaining a keen awareness of the organization’s economic well-being, founders can demonstrate to stakeholders that they are on top of their game. This proactive approach not only helps avoid unexpected liquidity issues but also positions the organization for sustainable growth and success.

Benchmarking and Financial Implications

Benchmarking expenditure burn against industry standards is a powerful tool for assessing financial efficiency. This practice enables organizations to measure their performance against peers, providing valuable insights for strategic decision-making. For example, organizations that reach $1 billion in yearly earnings and liquidity are frequently regarded as having confirmed their business model and market acceptance. These organizations, termed “established insurgents,” are rare, with only about 2,500 out of 225,000 companies founded in the last 20 years reaching this milestone. By comparing cash burn metrics, businesses can identify areas for improvement and make informed decisions to enhance their market position and drive long-term growth.

Conclusion

Understanding and managing cash burn rate is not just a financial necessity; it is a vital strategy for thriving in today’s competitive landscape. By grasping the intricacies of both gross and net burn rates, businesses can better navigate financial complexities and position themselves for sustainable growth. The shift towards operational efficiency, as highlighted throughout this discussion, serves as a cornerstone for extending cash runways and enhancing overall financial health.

The importance of proactive financial planning cannot be overstated. As market conditions continue to evolve, maintaining a disciplined approach to cash management becomes paramount. Companies that align their strategies with robust financial practices are better equipped to address challenges and seize opportunities.

By investing excess cash wisely and continuously reviewing financial statements, organizations can foster a culture of active cash management that not only mitigates risks but also promotes long-term viability.

Ultimately, the journey of mastering cash burn rate is one of empowerment. It enables businesses to transform potential obstacles into stepping stones toward success. With a keen focus on operational efficiency and strategic foresight, CMOs and their teams can confidently navigate the uncertainties of the market, ensuring their companies not only survive but thrive in a rapidly changing environment.

Embrace these principles and watch as the potential for growth unfolds.