How AngelList Invest Transforms Startup Funding

Introduction

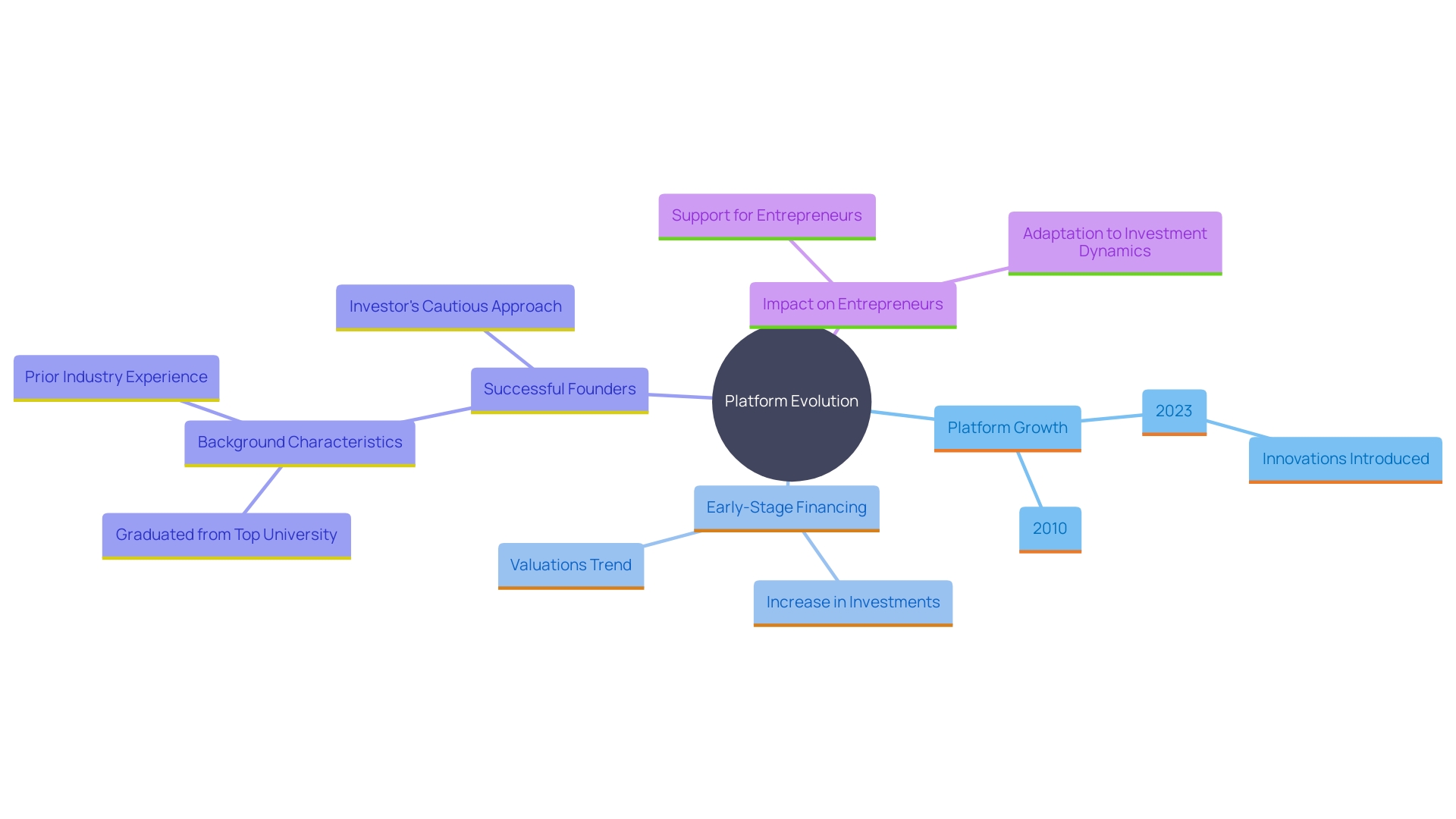

Since its 2010 debut, AngelList has reshaped how startups raise capital. What began as a simple directory is now a full-stack funding platform that streamlines founder–investor matchmaking and reduces friction across the private markets. By connecting startups to a broad, qualified network of angels, syndicates, and venture firms, AngelList removes traditional bottlenecks so founders can spend more time on product, growth, and talent.

2023 marked an inflection point: AngelList doubled down on infrastructure for the startup economy, enhancing core products and launching new software tailored to founders, GPs, LPs, and operators. From seasoned institutions to first-time fund managers and novice founders, the platform’s expanding toolset underscores its role as the operating system for early-stage finance.

Meanwhile, venture cycles continue to shift. Even as overall VC dollars dipped, early-stage funding rose ~10%, highlighting the importance of platforms that keep young companies liquid and moving. Founder pedigree also remains a factor: a meaningful share of seed-stage founders hail from top universities and bring prior industry experience—signals investors still weigh in early rounds.

In short, AngelList Invest remains a cornerstone of the startup ecosystem—accelerating innovation, widening access to capital, and supporting the next generation of breakout companies.

The Evolution of AngelList

Launched as a curated directory in 2010, AngelList evolved into a comprehensive funding and operations ecosystem. Today, it powers the full journey: from discoverability and signal amplification to syndicates, SPVs, rolling funds, and fund admin—all wrapped in compliant workflows.

2023 showcased this evolution. AngelList strengthened existing products and shipped transformative software for private-market stakeholders. In a year when many capital sources slowed, the platform’s product velocity helped founders keep deals on track and investors keep deploying.

Crucially, AngelList adapts to market structure: with overall VC down year-over-year but early-stage rounds up ~10%, the platform’s standardized tooling and network effects help founders overcome slower traditional processes—and help investors discover high-signal opportunities faster.

Signals still matter. Data shows founders with elite academic backgrounds (≈59%) and prior industry experience (≈50%) remain overrepresented in funded seed cohorts, reflecting what many investors prize: preparedness, relevance, and execution readiness. AngelList’s matching and diligence scaffolding help surface those strengths efficiently.

How AngelList Transforms Startup Funding

AngelList lowers the barrier to entry by making it simple to showcase a company, collect interest, and convert that interest into clean, compliant financing. Startups gain visibility with angels, syndicate leads, micro-VCs, and institutional funds, while investors get structured access to deal flow they can diligence quickly.

Community vehicles—like operator-led syndicates—democratize participation. Founders can share materials once and receive multiple soft-circles; leads can coordinate checks (often $25k–$50k each) to close rounds on tight timelines. In a market where year-to-date venture totals can fluctuate, networked capital matters; organizations like the Angel Capital Association underscore how distributed angel networks help fuel the earliest stages.

Benefits of Using AngelList for Startups

-

Faster Process, Less Overhead

Standardized docs, hosted data rooms, and integrated workflows compress time from intro → diligence → closed. -

Network Effects & Signal

Access a broad investor graph—angels, syndicate leads, and funds—without dozens of bespoke email threads. -

Trust & Compliance Built-In

KYC/AML, money movement, cap table alignment, and reporting handled in platform. -

Talent & Ops Adjacencies

The broader AngelList ecosystem (jobs, talent) compounds hiring and growth momentum.

Case in point: companies like Leya AI leverage AngelList to amplify distribution, attract talent, and scale efficiently—serving thousands of users across 100+ countries while keeping acquisition costs and operational complexity in check.

AngelList also reduces founder fatigue. Instead of 50+ introductory meetings to triangulate fit, the platform helps you pre-qualify investors who understand your category, speeding up the path to a lead and a properly constructed round.

Best Practices for Startups to Leverage AngelList

-

Craft a Sharp Narrative

Lead with problem → solution → why now → traction → business model → roadmap → ask. Use crisp visuals and concrete metrics. -

Optimize Your Profile & Updates

Keep metrics fresh (MRR/ARR, retention, pipeline, POCs) and post regular updates to keep your deal top-of-mind. -

Targeted Outreach > Spray-and-Pray

Map your category to relevant syndicate leads and angels (operator-market fit). Personalize messages with 1–2 sharp reasons they’re a fit. -

Close Cleanly

Use platform-native workflows to streamline subscriptions, SPVs, and cap table sync, minimizing legal back-and-forth. -

Engage the Community

Comment thoughtfully, share learnings, and be responsive. Reputation compounds—and so does follow-on capital.

AngelList Syndicates and Their Role in Funding

AngelList Syndicates enable a lead to pool capital from many backers into a single SPV—spreading risk, widening access, and making allocations efficient for founders. For investors, syndicates offer deal access and curation; for founders, they provide speed, signal, and a single cap-table line.

Operator-driven collectives (e.g., Operator Exchange) can quickly mobilize capital—individual checks up to $50k—and have funded a meaningful slice of the submissions they see. In choppy macro periods, syndicates keep checks flowing and let experts with domain advantage sponsor emerging winners.

Complementary tools (e.g., deal-ops platforms that automate banking, compliance, and reporting) further de-admin the process so leads can concentrate on sourcing, diligence, and supporting founders post-close.

Engaging with Investors on AngelList

-

Communicate Proactively

Post concise updates (wins, learnings, KPIs), respond promptly, and share clear next steps. Trust thrives on transparency. -

Show Execution Rhythm

Investors look for cadence—shipping velocity, customer signals, sales cycle compression, and roadmap clarity. -

Align on Milestones

Convert interest by anchoring on near-term proof points (pilot go-lives, gross margin targets, SOC 2 timeline, channel activation). -

Invest in Relationships

Respect, responsiveness, and shared objectives create the basis for future follow-ons and strategic introductions.

AngelList’s diverse customer base—from first-time founders to veteran fund managers—means startups can find the right capital partner for stage, sector, and strategy.

The Future of Startup Funding with AngelList

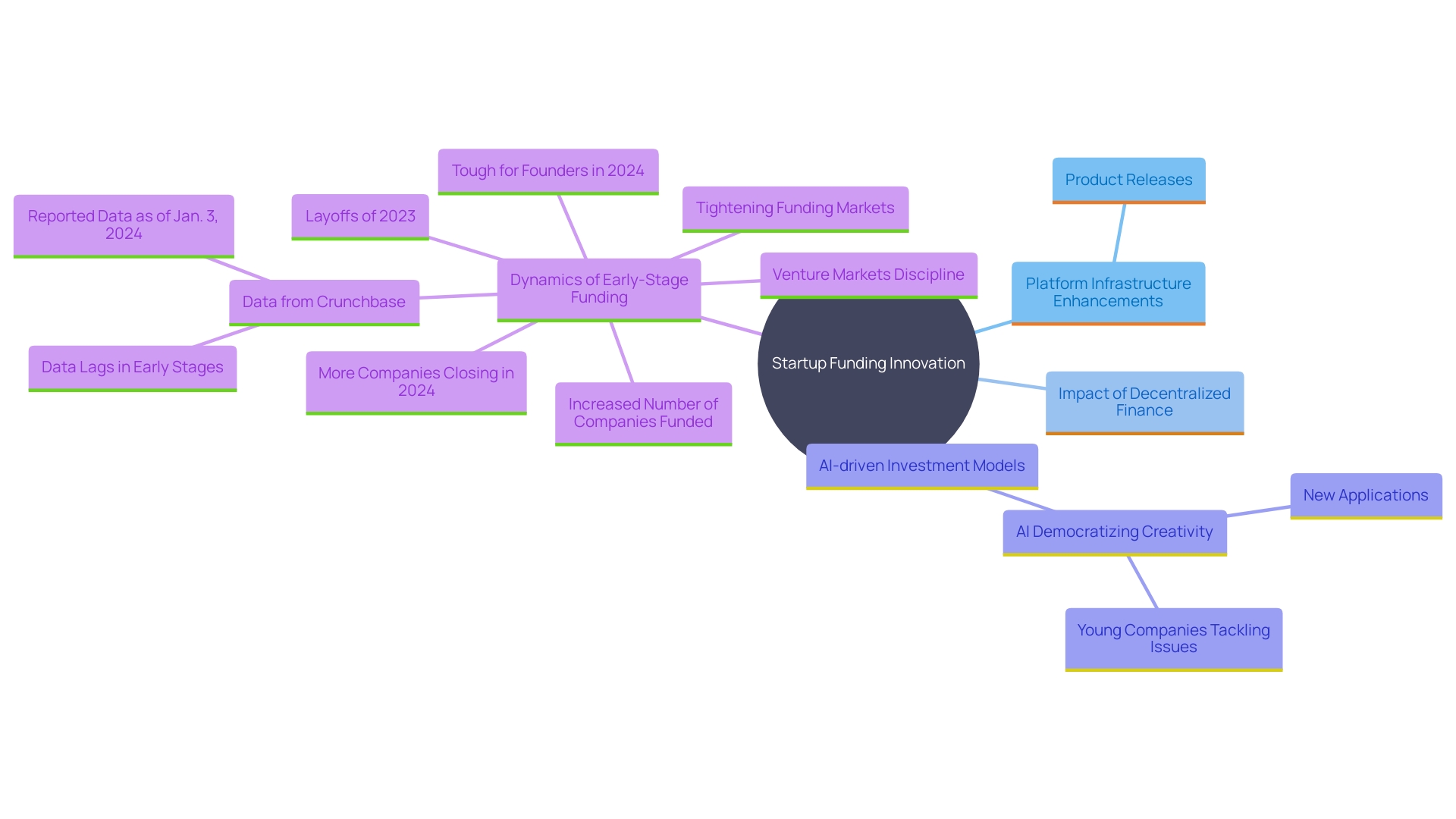

AngelList’s trajectory signals continued leadership in private-markets software. In 2023, the platform shipped 179+ product releases and launched six standalone software offerings, expanding support for founders, GPs, and LPs.

Looking ahead:

-

AI-Assisted Diligence & Matching

Expect smarter triage of deal flow and pattern-of-life analytics that surface breakout signals earlier—akin to “SuperForecaster” approaches that model unicorn-likelihood. -

Modular Capital Formation

More flexible SPVs, rolling vehicles, and hybrid structures that adapt to round dynamics and LP preferences. -

Interoperability Across the Stack

Tighter integrations among fund admin, banking, compliance, cap table, and reporting, reducing cycle time and errors.

Even with slower multi-stage fundraising, early-stage momentum (up ~10%) shows founders and angels remain active. AngelList’s product velocity and network liquidity position it to keep fueling innovation through varied market regimes.

Conclusion

AngelList has fundamentally modernized startup finance—from discovery and diligence to SPVs, syndicates, and fund operations. In a period when overall venture dollars may ebb and flow, the platform’s network effects, compliance rails, and software cadence help founders raise efficiently and help investors deploy intelligently.

Benefits extend well beyond capital: credibility, visibility, operational leverage, and a community that compounds your momentum. Success stories—like Leya AI—illustrate how leveraging AngelList can accelerate growth, hiring, and market penetration.

Syndicates have further democratized access, spreading risk and broadening participation, while AngelList’s ongoing product expansion keeps the ecosystem resilient and inclusive. With emerging trends—from AI-driven sourcing to modular fund structures—the platform is poised to remain the infrastructure layer for early-stage innovation.