Angel Investors in Florida: Fueling Startup Growth and Innovation in 2025

Introduction

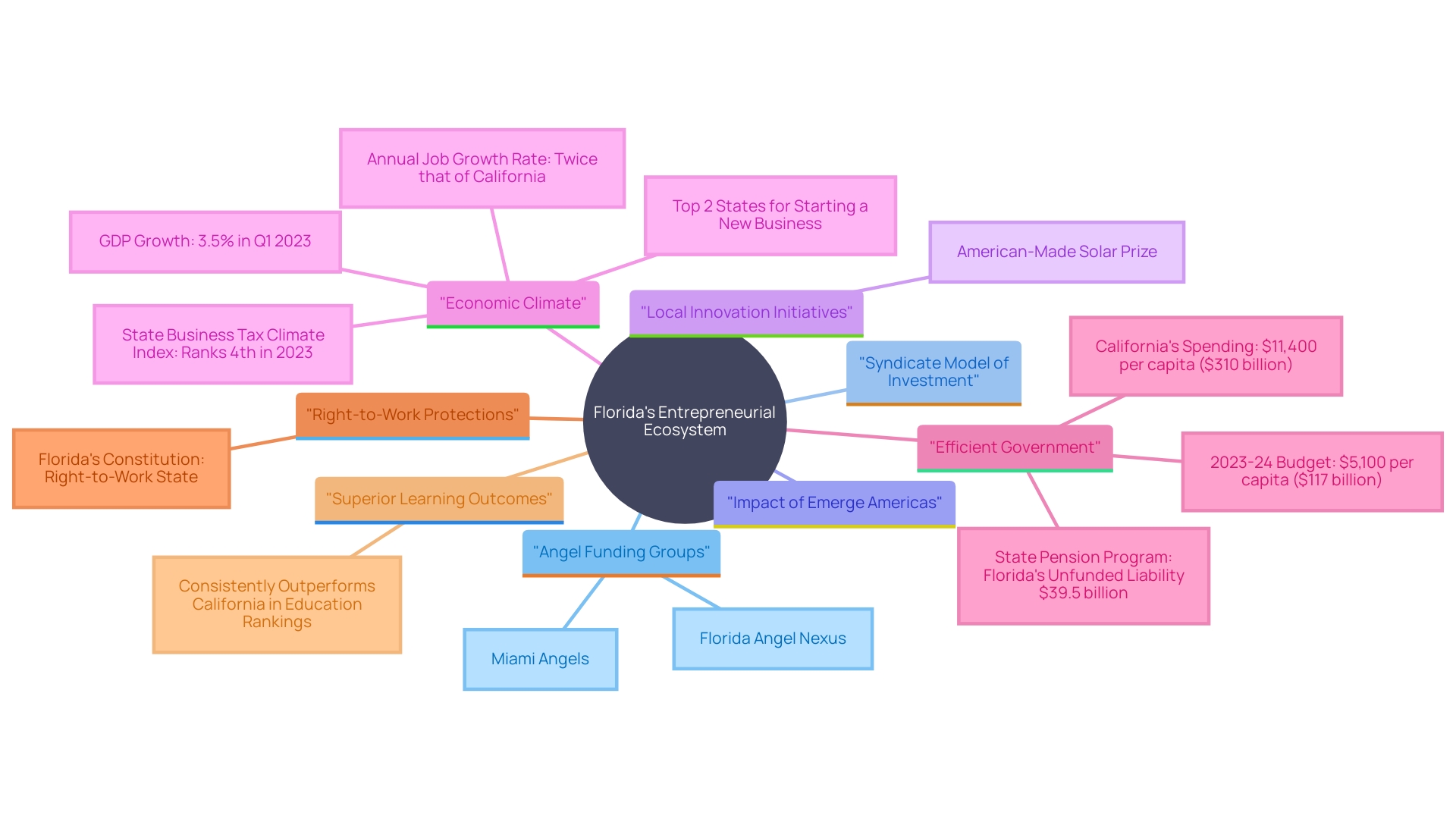

Florida’s startup ecosystem is booming—driven by a strong network of angel investors who are fueling early-stage innovation across the state. Key groups such as the Florida Angel Nexus and Miami Angels are at the forefront, connecting capital with promising startups. These angel networks do more than just fund—they mentor, guide, and empower entrepreneurs to navigate competitive markets with confidence.

By combining their financial power and business expertise, angel investor groups in Florida significantly increase the growth potential of new ventures. Through collaborative investment strategies and shared insights, these networks help startups scale faster and smarter.

In South Florida, the entrepreneurial scene continues to flourish. Despite broader economic challenges, recent investment data points to a surge in deals and funding rounds. High-impact events like eMerge Americas have played a pivotal role in building momentum—especially by supporting underrepresented founders and cultivating a vibrant innovation culture.

With a growing number of syndicate-style investments and collaborative efforts, angel investors in Florida are laying the foundation for a resilient, inclusive, and fast-growing startup ecosystem.

Key Angel Investor Groups in Florida

Florida is home to a robust and active network of angel investor groups, which form the backbone of the state’s startup funding landscape. Organizations like the Florida Angel Nexus and Miami Angels are vital in bridging the gap between early-stage startups and the capital, guidance, and mentorship they need to succeed.

These groups enable high-growth startups to scale quickly by pooling financial resources, sector expertise, and business connections. Their collaborative model not only spreads risk but also amplifies the effectiveness of their investments—making them a powerful force within Florida’s entrepreneurial ecosystem.

In South Florida, this momentum is backed by data. According to Pitchbook, startups in the region secured nearly $1.7 billion across 260 deals in the first three quarters of 2024 alone. Events like eMerge Americas—a flagship tech conference—have catalyzed much of this progress. Since its launch, alumni from the eMerge Americas Accelerator + Showcase have raised more than $2.5 billion, with 72% of participants coming from minority and underrepresented backgrounds.

A key driver of this growth is the syndicate model, a popular structure among angel investors. In this setup, a group of investors collectively fund startups, often led by a deal lead or coordinator. This approach allows participants to diversify risk, pool knowledge, and offer more strategic value beyond capital. As one expert puts it, “Angel investing empowers early-stage businesses to launch, grow, and succeed—through capital, mentorship, and hands-on business guidance.”

Angel investors in Florida often focus on sectors they know well, which helps minimize risk and increase the success rate of portfolio companies.

Adding to Florida’s innovation momentum are initiatives like the American-Made Solar Prize. Miami-based Pavilion Solar, a semifinalist in the competition, showcases how Florida startups are leveraging angel support to develop transformative technologies in clean energy and beyond.

Together, Florida’s angel investor networks, innovation-focused programs, and inclusive funding approaches make the state one of the most promising startup hubs in the U.S.

Investment Criteria and Process for Angel Investors in Florida

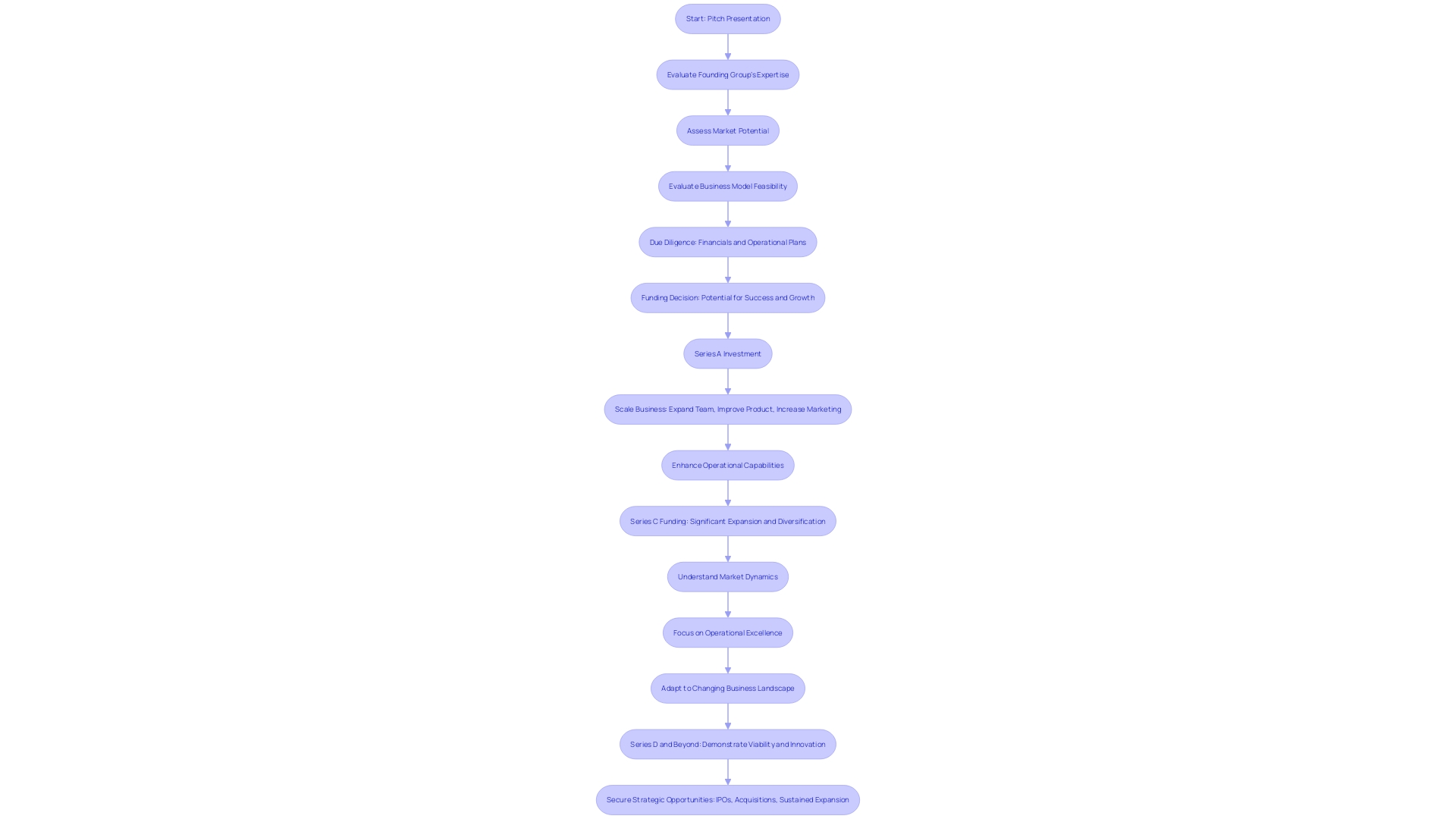

Angel investors in Florida follow a strategic and structured approach when evaluating early-stage startups. Their investment criteria typically center around a few core elements: the strength of the founding team, the scalability of the business model, the size of the addressable market, and the uniqueness of the solution.

Startups that stand out are often those offering innovative solutions to real market problems. Angel backers seek ventures that tackle specific pain points—especially in high-growth industries like healthtech, fintech, clean energy, and enterprise SaaS. A strong, differentiated value proposition is key to sparking investor interest.

The angel investment process usually begins with a pitch presentation. Founders must clearly communicate their mission, product-market fit, and long-term vision in a compelling way. This initial pitch is crucial—it sets the tone for deeper evaluation and due diligence.

Once a startup passes the pitch phase, the next step is due diligence, where investors analyze:

-

Financial statements and projections

-

Market research and competitive landscape

-

Team capabilities and operational strategies

-

Exit potential and historical traction

One critical performance metric is MOIC (Multiple on Invested Capital), which measures returns against initial capital invested. Investors use this to estimate long-term profitability and assess whether a startup is worth the risk.

The current funding environment is shifting. Early-stage investments have increased by ~10%, while late-stage funding has declined by ~20%, according to recent reports. This trend highlights the growing importance of angel capital, particularly in Florida, where startup activity is accelerating.

For founders, selecting the right backer goes beyond funding. A committed angel investor provides mentorship, strategic guidance, and valuable connections, which can drastically influence a startup’s trajectory. In a volatile fundraising climate, having a dedicated, hands-on investor is more important than ever.

Whether you’re pitching to a Florida-based angel network or building traction pre-funding, understanding this process is essential to securing capital and scaling effectively.

Benefits of Angel Investing for Startups and Investors

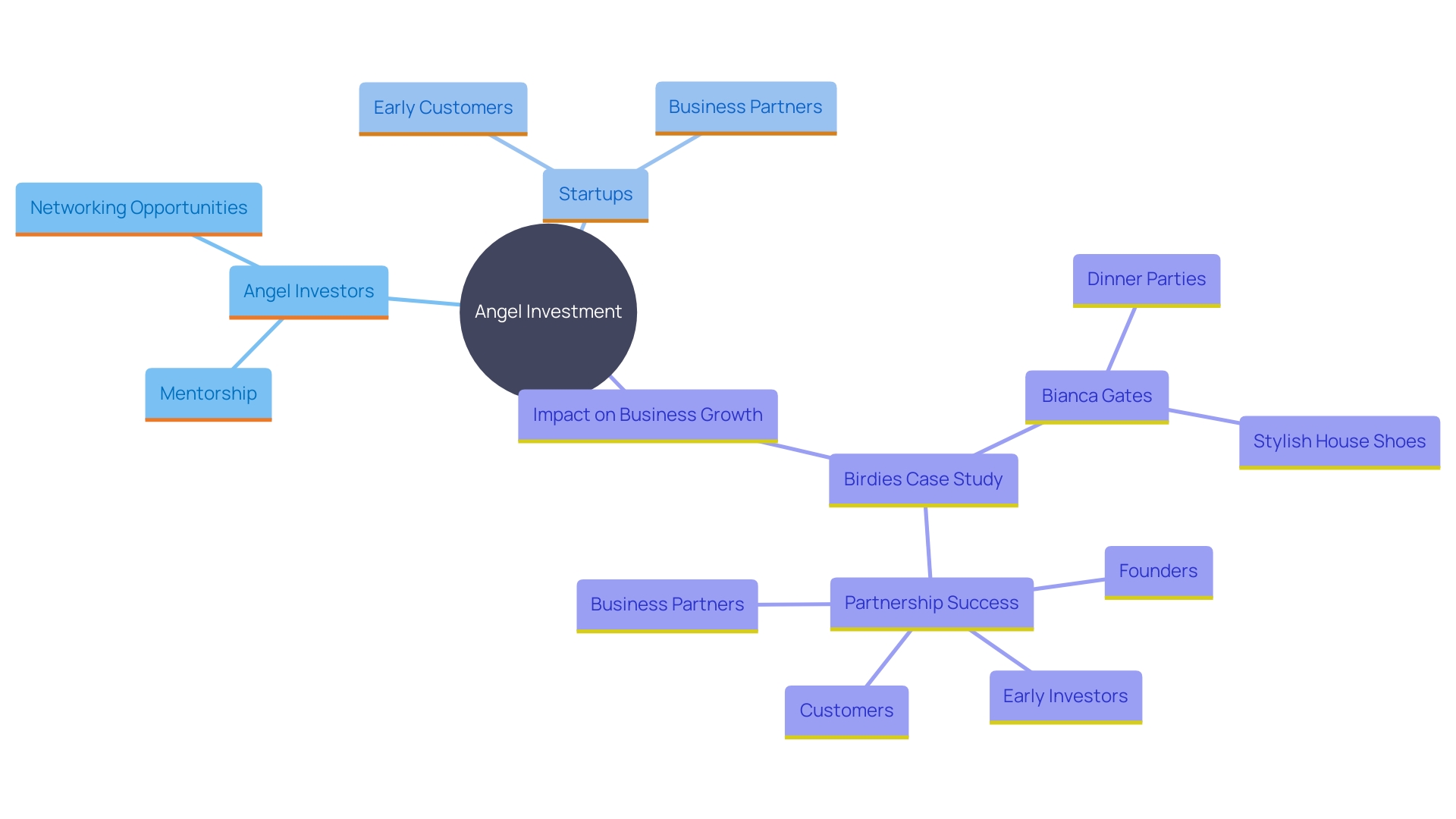

Angel investing offers a powerful dual benefit—fueling startup growth while providing investors with the opportunity to back innovation and earn significant returns. For early-stage startups, angel capital serves as more than just funding. It opens the door to strategic mentorship, industry connections, and hands-on guidance that accelerates business growth.

Organizations like the Angel Capital Association (ACA) exemplify the formal support structure behind these investments, offering resources that strengthen relationships between accredited investors and high-potential startups.

Angel investors frequently act as mentors and advisors, helping founders refine their business models, navigate challenges, and scale efficiently. Their involvement goes beyond money—they often bring deep industry knowledge, strategic insight, and access to a wider investor or customer network.

Take the case of Birdies, a brand that transformed the market for stylish indoor footwear. Co-founder Bianca Gates spotted a market gap during her dinner parties and turned her idea into a thriving business with the help of early angel investment. These investors didn’t just write checks—they helped shape the company’s vision and roadmap, turning a concept into a successful consumer brand.

For investors, angel investing in Florida and across the U.S. presents a unique opportunity to get in early on breakthrough ideas and shape the future of industries they understand. While there’s inherent risk, the potential ROI (return on investment) can be substantial—especially when backing startups with strong teams and product-market fit.

The startup capital landscape is also evolving. Although venture capital funding has declined by around 7% year over year, early-stage investments have increased by approximately 10%. This trend reflects a shift toward supporting nascent businesses with high potential, where angel investors play a key role.

In this changing environment, angel investment continues to drive innovation, support diversity in entrepreneurship, and fuel the next generation of high-growth ventures. It’s a win-win: startups receive the capital and support they need, while investors gain a front-row seat to innovation—and a stake in its success.

Challenges and Opportunities in Florida’s Angel Investing Landscape

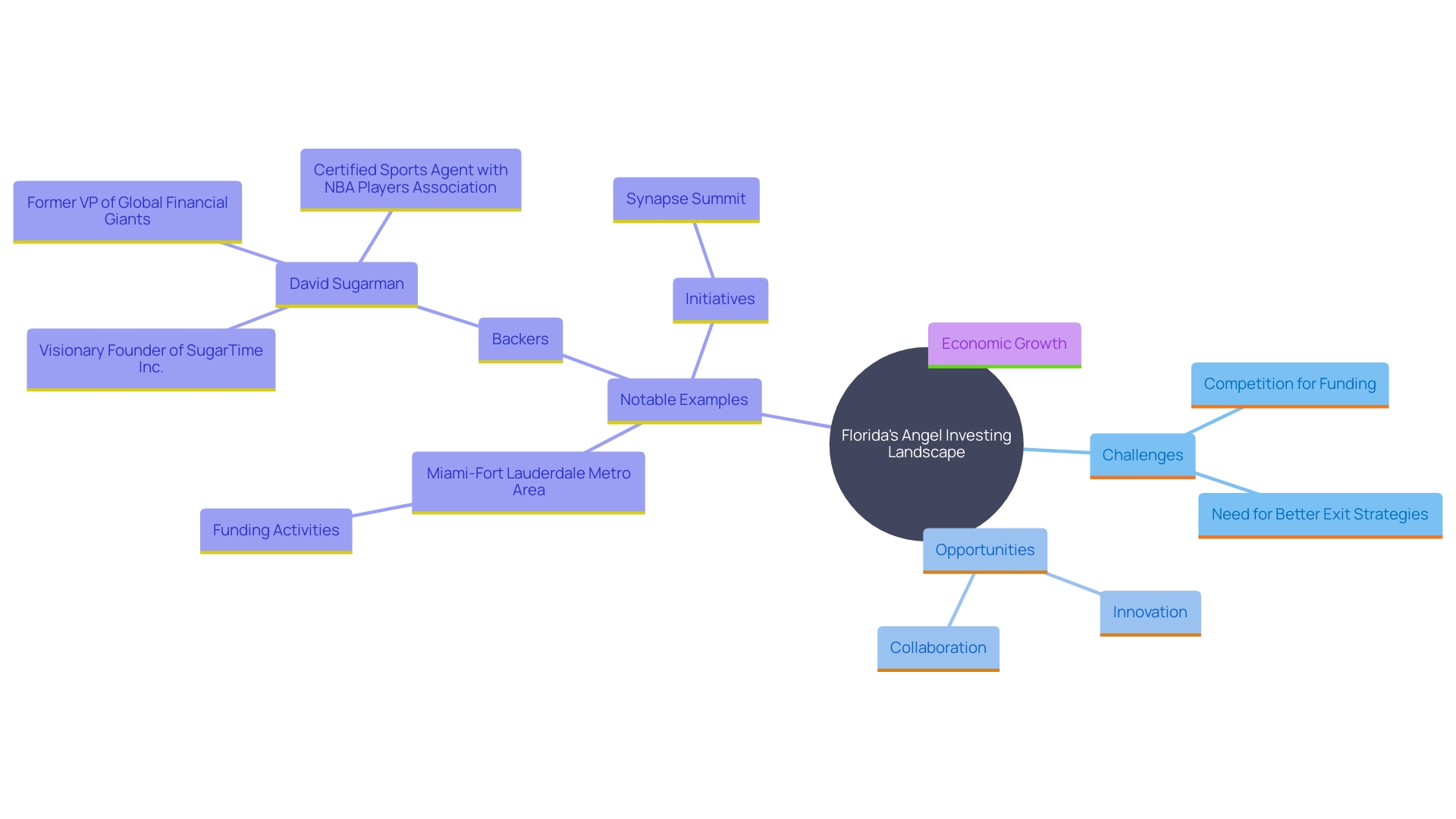

Florida’s angel investing ecosystem is growing rapidly—but like any dynamic market, it faces its share of challenges. From intense competition for funding to limited exit opportunities, startups and investors alike must navigate a complex environment. However, these obstacles also present a unique chance for innovation, collaboration, and long-term strategy.

In the Miami–Fort Lauderdale metro area, startup funding remains strong, with $1.7 billion raised across 260 deals in the first three quarters of 2024. While this marks a decline from the $5.8 billion peak in 2022, it underscores continued investor confidence in the region’s startup potential. As the Angel Capital Association (ACA) highlights, a strong investor network and hands-on support can significantly shape the trajectory of early-stage ventures.

A notable example is SugarTime Inc., led by David Sugarman, which has gone beyond capital injection to provide strategic mentorship. Their model proves how investors who are deeply involved can help companies hit global milestones and expand impact across industries.

In addition, ecosystem-building initiatives like the Synapse Summit in Tampa are cultivating a culture of innovation, inclusion, and growth. By bringing together entrepreneurs, investors, and thought leaders, events like these foster collaboration and help Florida maintain its edge as a rising startup hub.

To sustain momentum, angel investors in Florida must adapt to shifting market dynamics, including changing funding cycles and evolving valuation benchmarks. Leveraging strong professional networks, strategic insights, and industry specialization will be key to unlocking long-term success.

Despite its hurdles, Florida’s angel investing scene presents abundant opportunities—for investors looking to shape the future, and for startups eager to scale with the right partners by their side.

Notable Angel Investors in Florida and Their Impact on Startup Growth

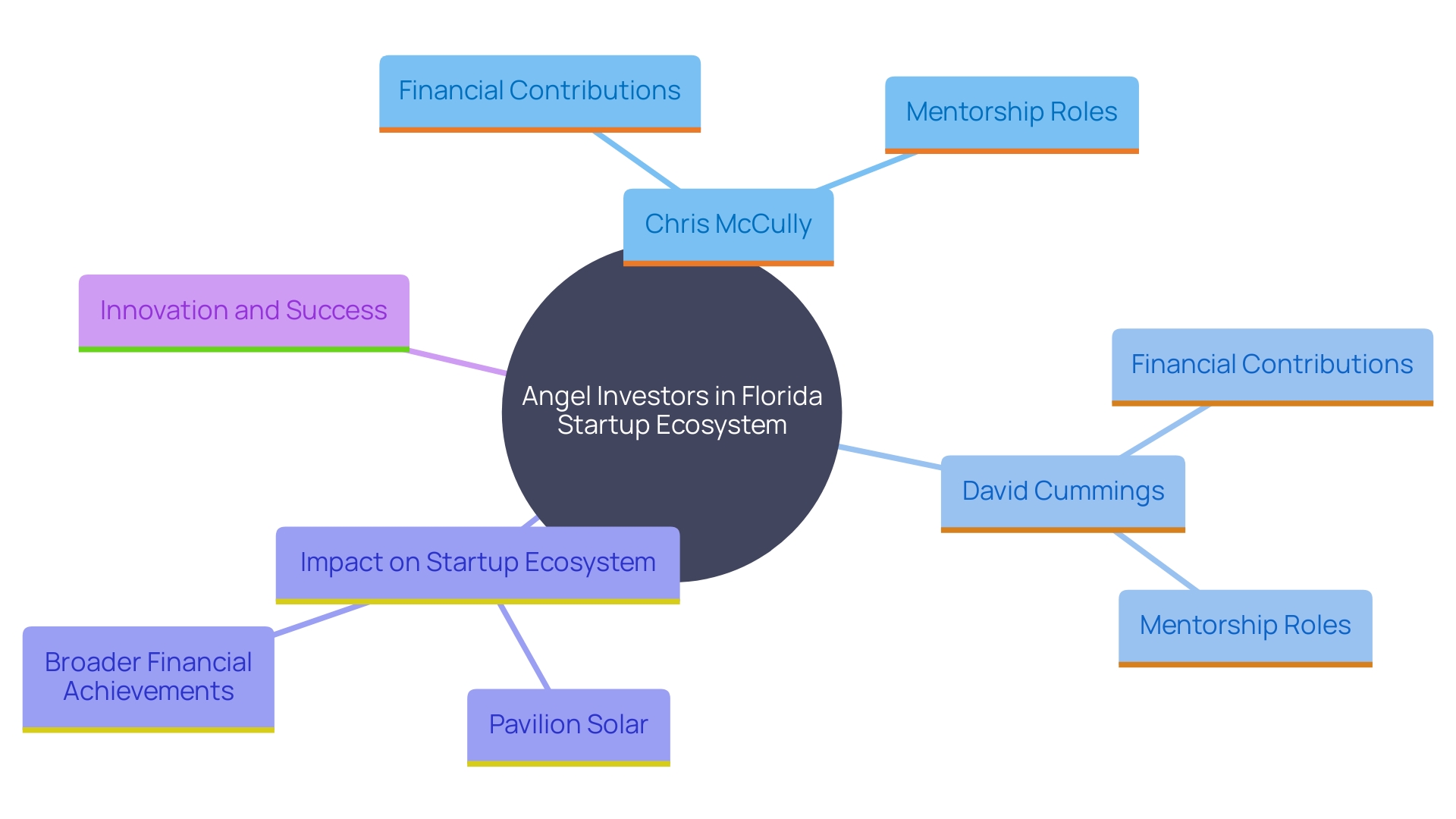

Florida’s startup ecosystem owes much of its momentum to the dedication of notable angel investors who contribute far more than just capital. Influential figures like Chris McCully and David Cummings have significantly shaped the region’s entrepreneurial landscape by offering not only financial backing but also mentorship, strategic insight, and invaluable industry connections.

Their impact is reflected in the numbers: the Miami–Fort Lauderdale metro area secured $984.2 million across 176 deals in the first half of 2024 alone. These investors play a key role in that success, often acting as long-term partners who help startups overcome early-stage hurdles and navigate toward sustainable growth.

Chris McCully has earned recognition for his hands-on approach in supporting emerging ventures across Florida, emphasizing the value of strategic backing during a company’s most formative stages. David Cummings, meanwhile, has used his extensive network to support a wide range of startups, contributing to South Florida’s impressive $2.4 billion in funding raised in 2023. Their influence is proof that the right investor—one who brings both capital and commitment—can be a catalyst for extraordinary achievements.

These success stories continue to inspire a new wave of entrepreneurs, showing that with the right guidance and backing, it’s possible to scale even in competitive and uncertain markets.

A standout example of this innovation is Pavilion Solar, a Miami-based startup and semifinalist in the American-Made Solar Prize. Backed by forward-thinking investors, the company is developing next-generation solar technology and gaining national recognition. Pavilion Solar represents the kind of high-potential startup that thrives when paired with experienced, mission-aligned angel investors.

In Florida, choosing the right angel investor can mean the difference between stagnation and scale. Investors like McCully and Cummings prove that effective angel investing isn’t just about funding—it’s about providing a strategic foundation that drives long-term success.

Conclusion

Florida’s startup ecosystem stands as a testament to the power of collaboration between angel investors and emerging entrepreneurs. The dynamic network of angel investor groups, such as the Florida Angel Nexus and the Miami Angels, is instrumental in providing not only essential funding but also mentorship and strategic guidance. This synergy empowers startups to navigate challenges and seize opportunities, propelling them toward rapid growth.

The criteria that angel investors use to evaluate potential investments emphasize the importance of innovation and market relevance. Startups that present unique solutions to pressing challenges capture the attention of investors, who are keen to back ventures with genuine potential. As the landscape of funding evolves, the focus on early-stage investments highlights the critical role of engaged investors who contribute not only capital but also invaluable mentorship.

Despite challenges such as competition for funding and the need for effective exit strategies, the opportunities within Florida’s angel investing scene are abundant. Initiatives that foster collaboration and innovation demonstrate the resilience and adaptability of the ecosystem. Prominent angel investors are not only shaping the market with their financial support but are also inspiring a new generation of entrepreneurs, proving that with the right guidance, remarkable success is within reach.

In conclusion, Florida’s thriving startup ecosystem is a powerful reminder of the impact of dedicated angel investors. Their commitment to nurturing innovation and supporting underrepresented founders is essential for driving growth and fostering a vibrant entrepreneurial landscape. Embracing these opportunities can lead to exciting possibilities, where startups can thrive and make a lasting impact.