Crafting Effective Investment Memos – Best Practices, Components, and Insights

Introduction: Why an Investment Memo Matters

Navigating the dynamic landscape of investment opportunities requires more than instinct — it demands a well-structured, data-driven approach. An investment memo is a critical blueprint for decision-makers, capturing the essence of an opportunity and presenting it in a concise, persuasive way.

This guide explores investment memo best practices — from executive summaries to financial projections — and offers proven strategies to enhance clarity, engagement, and credibility. By avoiding common pitfalls, leveraging technology, and addressing investor concerns, you can transform data into actionable insights that drive exceptional investment outcomes.

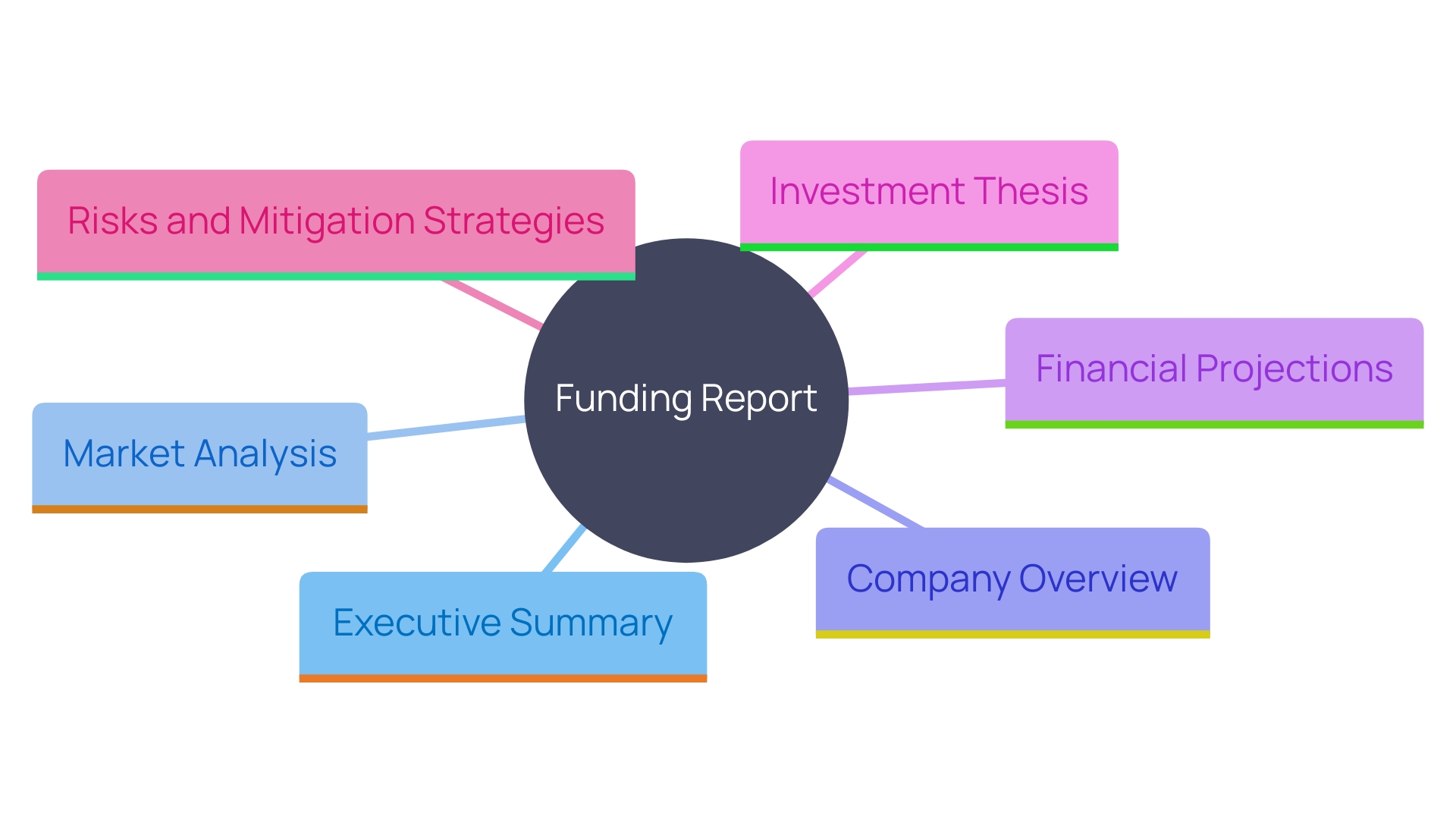

Key Components of an Investment Memo

An investment memo (also referred to as a funding report) is a structured document summarizing a potential funding opportunity. These are the essential sections:

1. Executive Summary

Provides a concise overview of the investment opportunity, capturing primary insights such as market potential, value proposition, and expected return. This snapshot should immediately inform and attract investors.

2. Market Analysis

Outlines relevant market analysis for investors, including industry size, growth opportunities, and competitive dynamics. Highlight trends, regulatory changes, and emerging market shifts that could influence the company’s future.

3. Company Overview

Details about the company’s mission, product or service offerings, leadership, history, and competitive edge. This section answers who you are and how you stand out.

4. Financial Projections

Clear, realistic financial projections in investment memos are vital. Include anticipated revenues, expenses, and profit forecasts for at least 3–5 years. Visual aids like charts or graphs help investors quickly grasp growth trajectories.

5. Investment Thesis

A compelling argument answering “Why invest now?” Identify drivers of growth and profitability, supported by credible data and strategic reasoning.

6. Risks and Mitigation Strategies

Honest discussion of potential investment risks with concrete mitigation plans. Demonstrating foresight in risk planning builds investor trust.

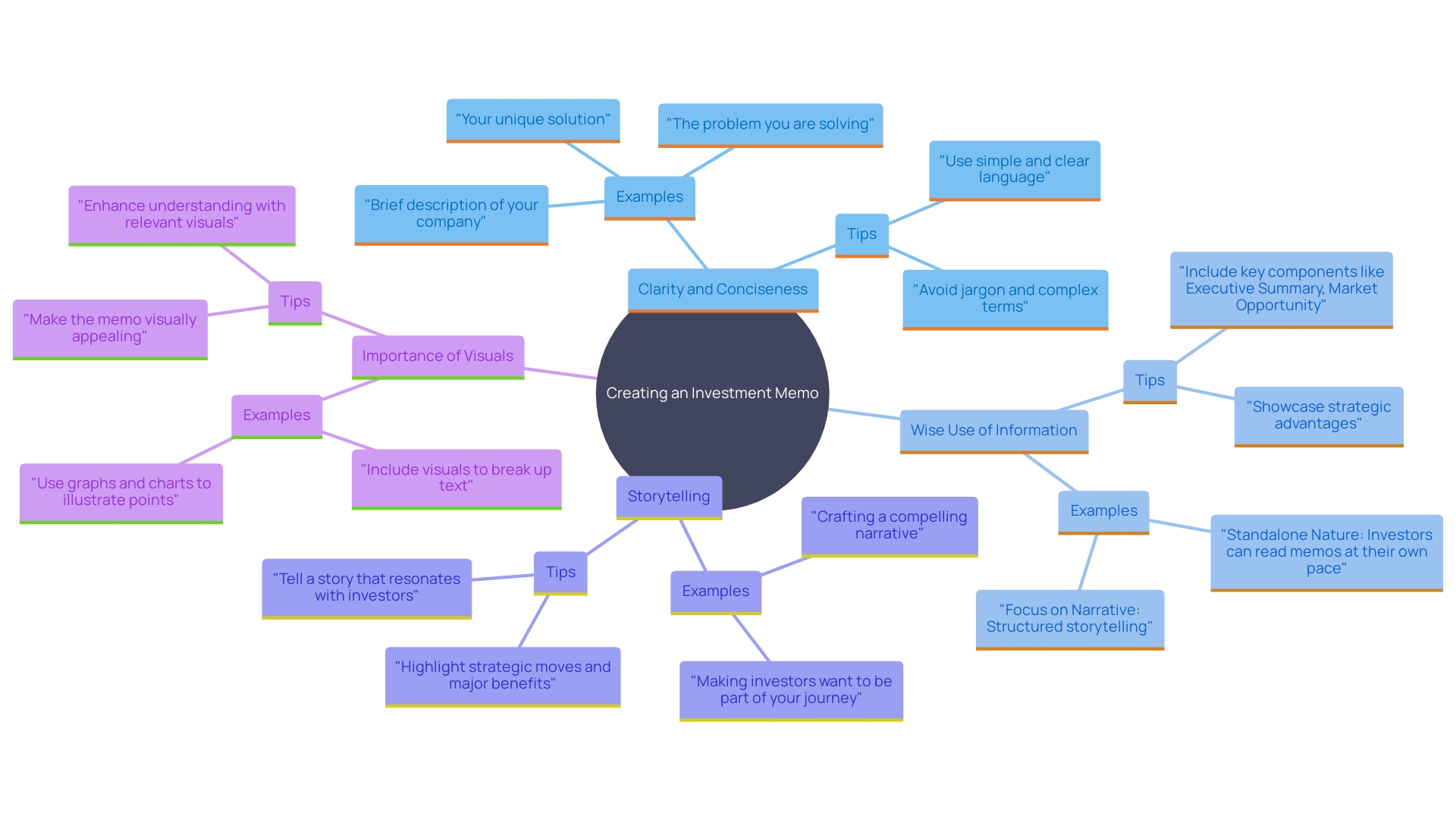

Essential Tips for Writing Effective Investment Memos

Be Clear and Concise

Avoid excessive jargon. Ensure each section delivers a clear point that non-technical stakeholders can easily grasp.

Use Data Wisely

Support claims with relevant statistics, but avoid overwhelming readers. Example: The consumer price index increased 3.1% in November 2024, signaling economic conditions that may affect investment returns.

Tell a Story

Weave together market need, company strength, and potential upside as a narrative. Like the Berkshire Hathaway turnaround story, demonstrate a clear growth arc.

Focus on Visuals

Incorporate charts, infographics, and tables. Visuals improve comprehension — 90% of top-performing PR content includes multimedia.

Common Mistakes in Investment Memos

Avoid:

-

Information Overload – stay focused on material facts.

-

Poor Presentation – professional formatting with clear headings boosts perceived credibility.

-

Ignoring the Audience – tailor tone and data to the specific investor type.

-

Downplaying Risks – transparency builds trust.

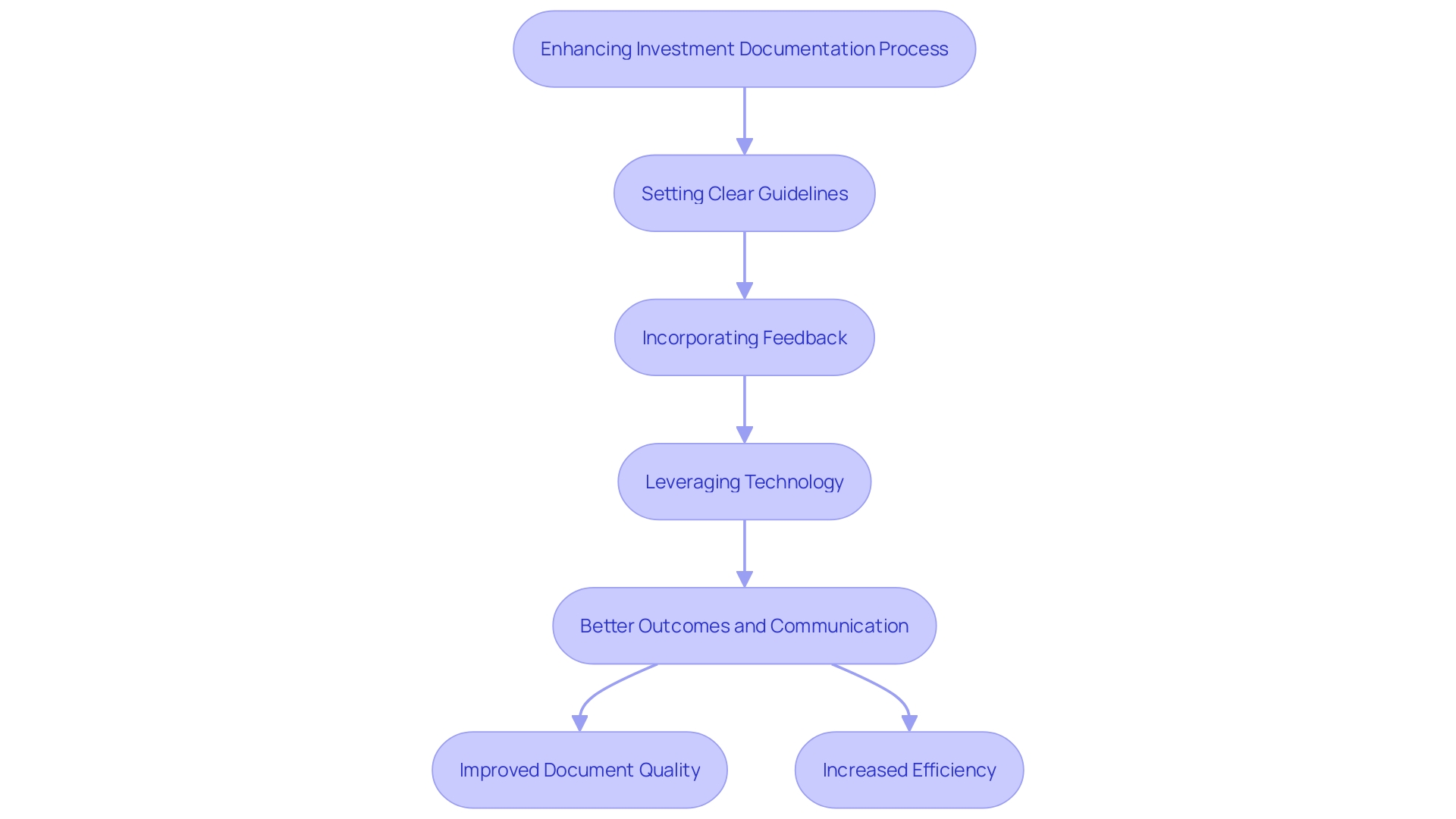

Improving the Investment Memo Process

-

Set Clear Guidelines: Use a standardized investment memo template for consistent structure.

-

Encourage Feedback: Invite collaboration from multiple stakeholders during drafting.

-

Leverage Technology: Use tools for financial modeling, real-time collaboration, and data visualization.

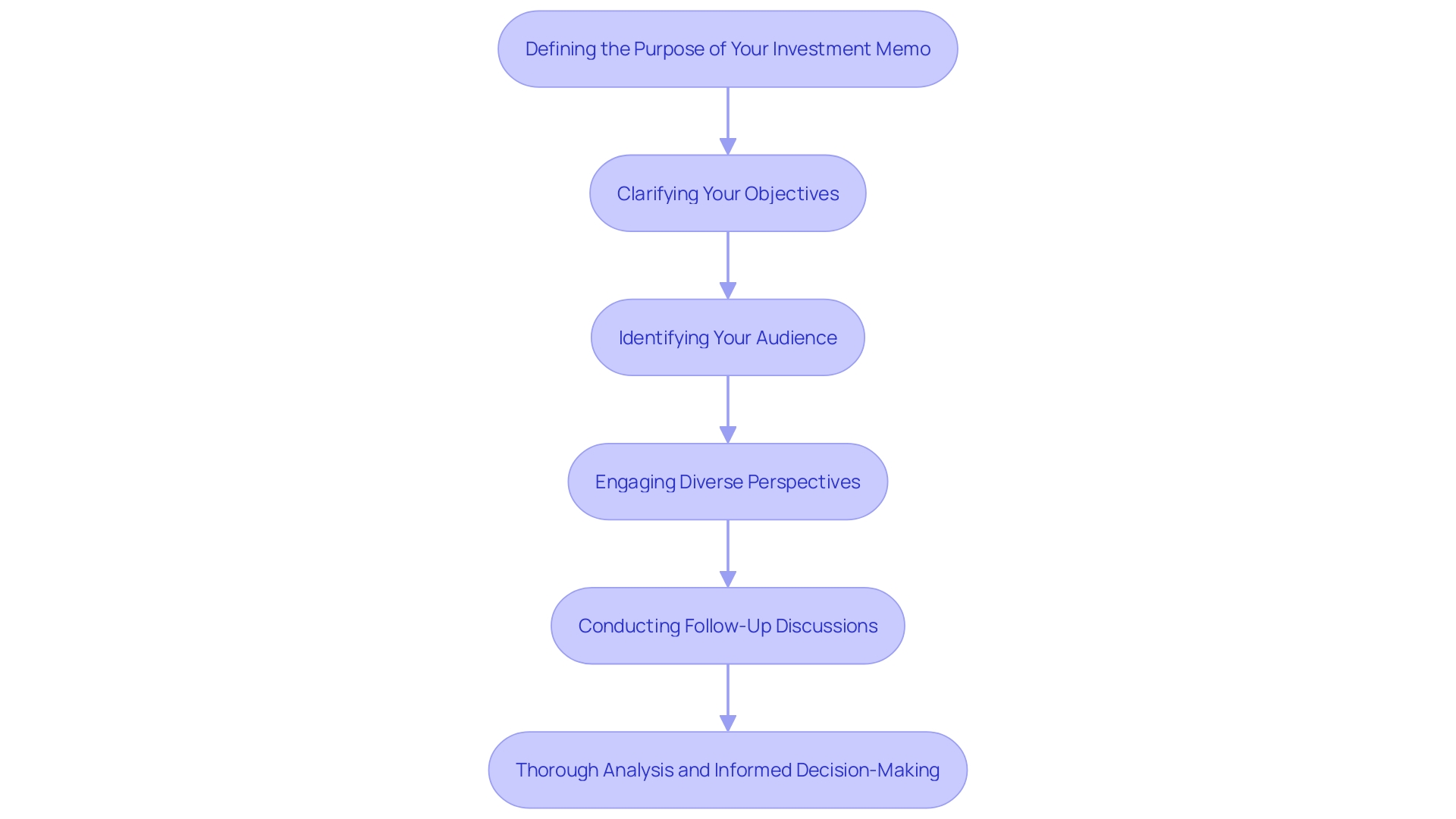

Addressing Investment Risks and Objections

-

Identify Key Risks upfront to frame transparency.

-

Propose Solutions to reassure investors.

-

Anticipate Objections relating to returns, timelines, or market volatility.

Best Practices for Evaluating Investment Memos

-

Establish Evaluation Criteria tied to your investment strategy.

-

Engage Diverse Perspectives for a multi-angle review.

-

Hold Follow-up Discussions to clarify details before committing capital.

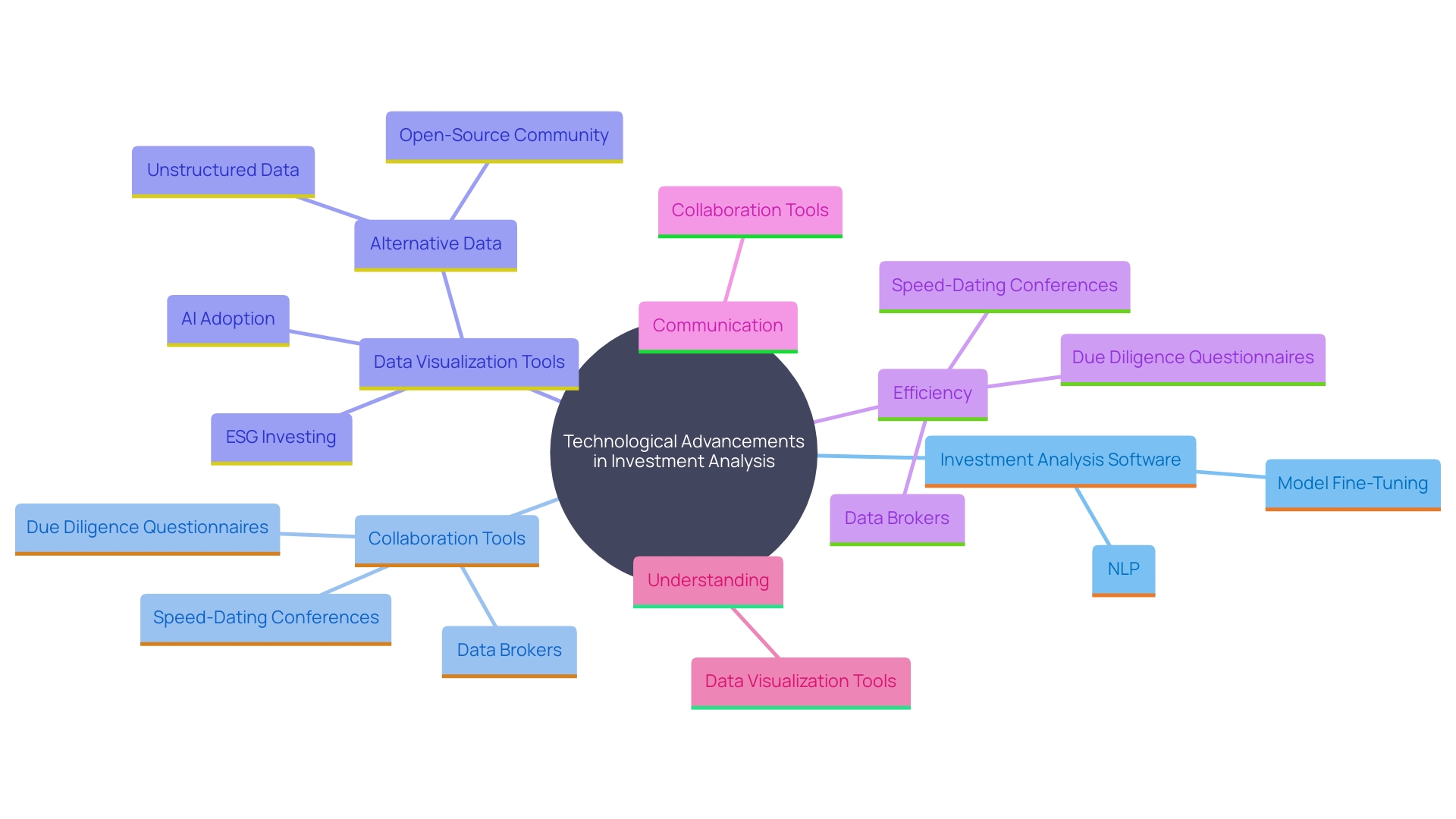

Utilizing Technology and Tools for Deal Analysis

-

Investment Analysis Software for advanced modeling and scenario planning.

-

Collaboration Platforms for quicker document feedback loops.

-

Data Visualization Tools to translate complex metrics into digestible insights.

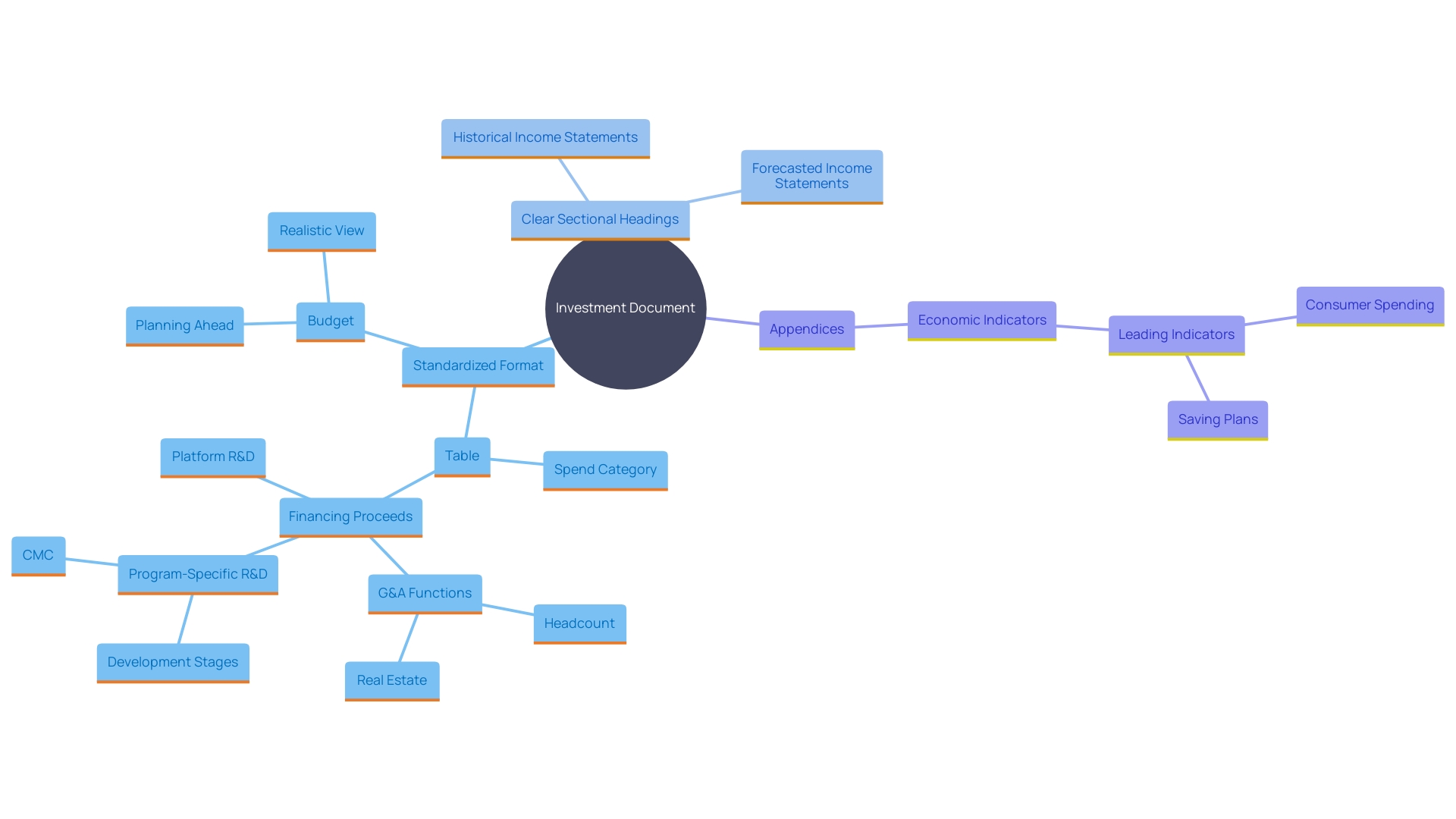

Effective Memo Structures and Templates

-

Use a standardized format with clear headings.

-

Include appendices for detailed data while keeping the main body concise.

-

Present a compelling investment narrative backed by market analysis and projections.

Conclusion

A strong investment memo blends clarity, strategic thinking, and structured storytelling. By integrating market analysis, realistic financial projections, clear risk mitigation strategies, and compelling reasoning, you create a persuasive document that empowers investors to make informed decisions.

By embracing best practices, collaborating with stakeholders, and leveraging technology, you can turn a memo into a strategic asset — one that not only informs but also inspires investor confidence and drives long-term success.