Analyzing the Strategic Investments of Conviction Partners

Introduction

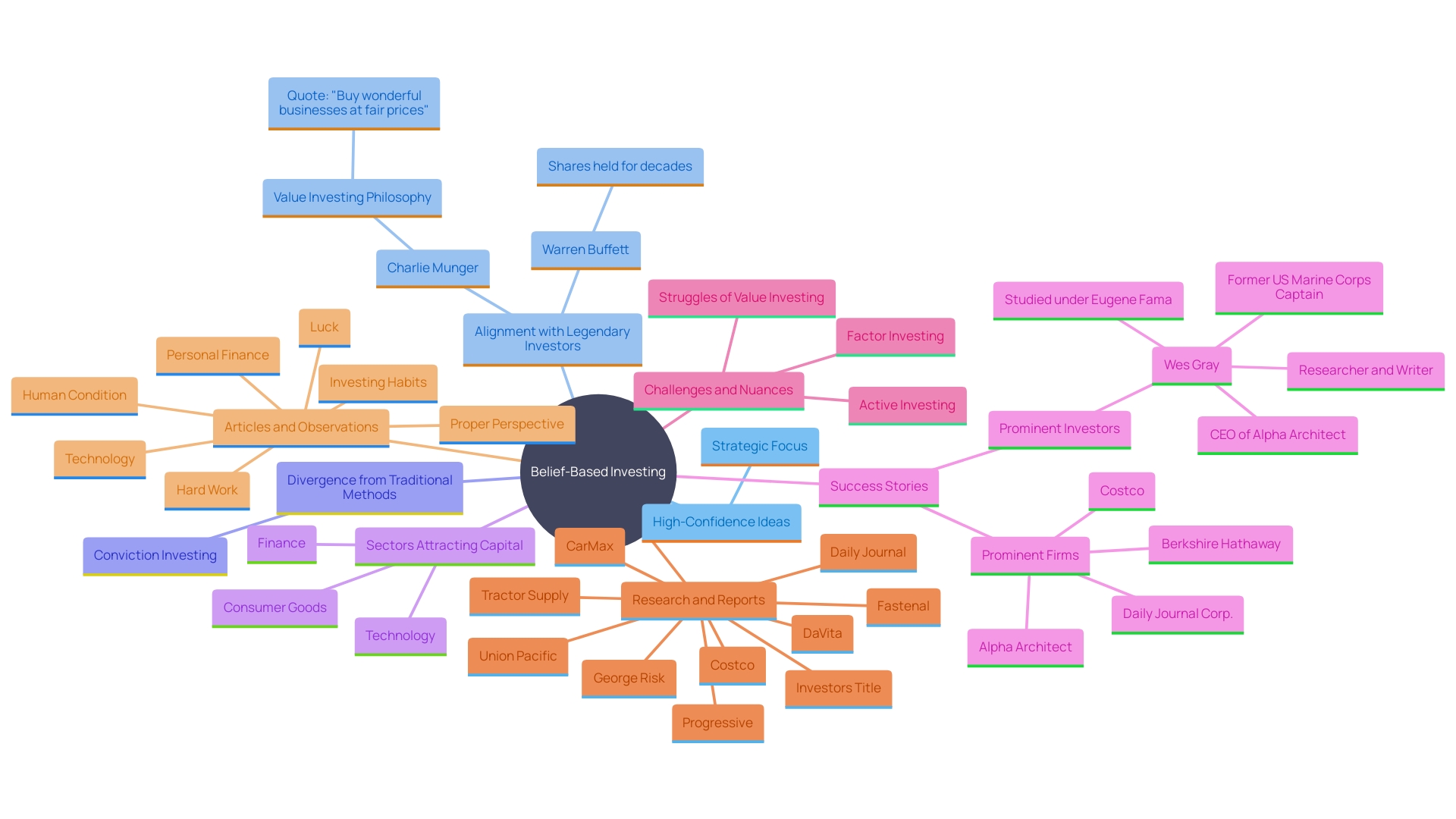

In the rapidly-evolving investment landscape, achieving superior returns often depends on the ability to navigate complex financial markets with precision and strategic foresight. Conviction investing is an influential approach, where investors deploy meaningful capital into a few high-conviction opportunities—deviating from conventional diversified portfolios. Leading firms like Conviction Partners champion this model, investing in startups set to revolutionize markets and drive innovation.

By prioritizing high-growth industries and leveraging sector-specific expertise, these firms go beyond financial backing, offering strategic guidance that magnifies their portfolio companies’ odds of success. This article explores the principles of conviction investing, the strategic importance of portfolio concentration, and the integration of data-driven analytics with deep fundamental research. Through practical examples and expert insights, discover how conviction investing fuels significant returns and generates transformational value within today’s competitive investment environment.

Understanding Conviction in Investment Strategies

Conviction investing is a targeted approach where investors commit substantial resources to select high-confidence ideas, as opposed to traditional, risk-dispersed portfolios. Firms like Conviction Partners allocate their capital to startups positioned to disrupt markets and deliver superior returns. Their disciplined strategy is designed for meaningful value creation and long-term innovation.

This investing philosophy draws on legends like Warren Buffett, emphasizing patience and extensive knowledge of investment assets. Peter Lynch’s principle—investing in what you know—also underpins conviction investing strategies.

Despite recent global declines in venture capital funding, sectors such as technology and telecommunications continue to attract robust investment, representing 32.8% of the total. Conviction Partners targets these dynamic sectors, aiming to capitalize on innovation and sustained growth.

Marc, an experienced venture capitalist with 25+ years in the industry, illustrates how focused investing leads to outstanding performance. His shift from Consumer Venture Associates to co-founding BEV Capital, raising and investing over $200million, demonstrates the transformative potential of conviction strategies. By building a concentrated portfolio of high-growth startups, Conviction Partners seeks to echo this success, driving innovation and significant returns.

The Role of Concentration in Conviction Investing

Focus in portfolio management resembles a balancing act—capable of generating strong returns, but exposing investors to higher risk if individual bets falter. Conviction Partners accepts this challenge by favoring high-potential sectors like technology and biotech, leveraging deep specialization. Their concentrated strategy delivers not just funding, but vital strategic support and industry resources, dramatically increasing success rates for startups. This methodology aligns with leading examples like Topicus, whose commitment to organic growth and specialization secures resilient revenue streams. The recent rise in biotech mergers and acquisitions further demonstrates the sector’s strategic value and return potential, even as the broader life sciences market remains cautious.

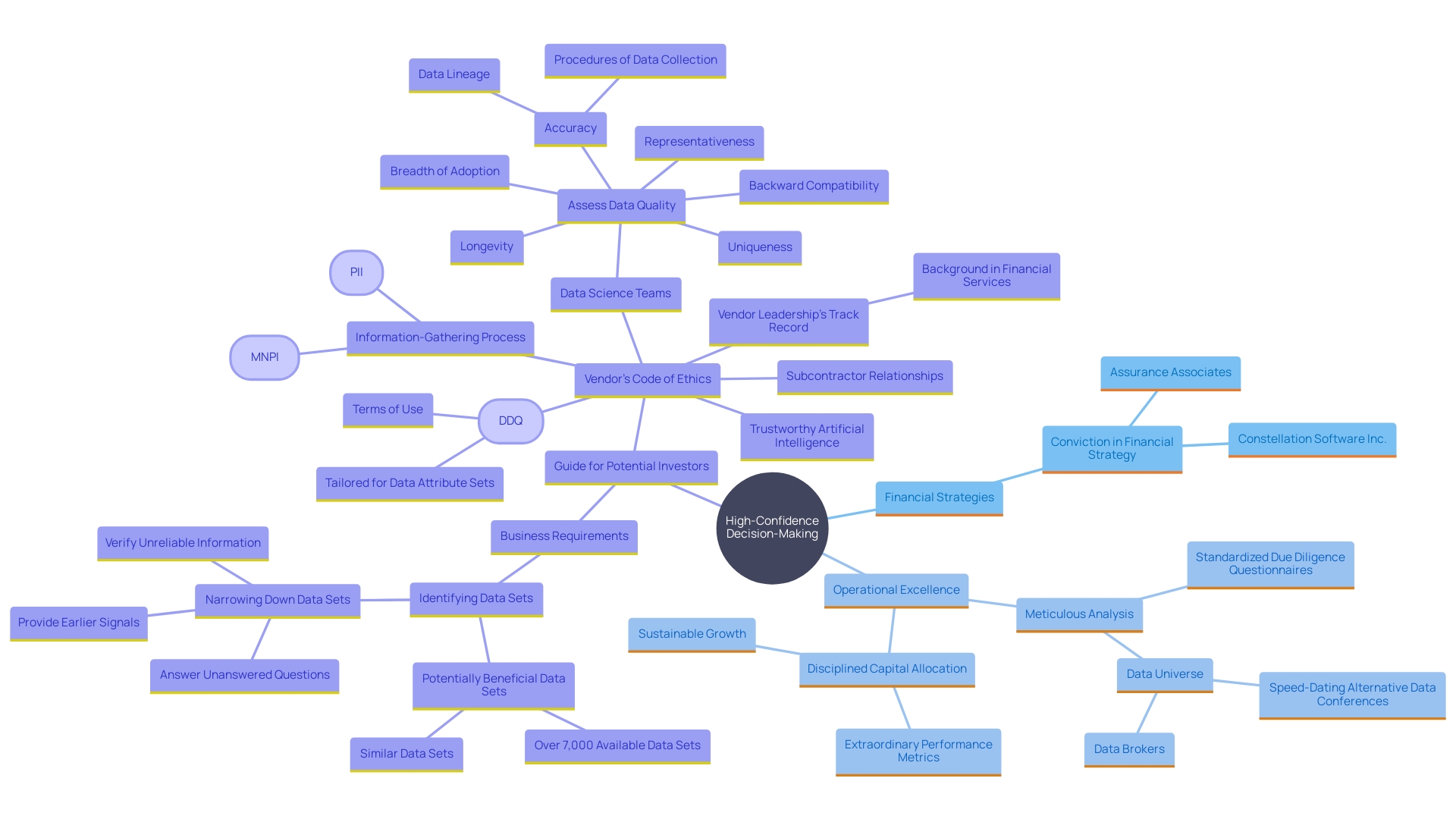

Quantitative vs. Fundamental Approaches to Conviction

Conviction Partners employs an advanced financial framework, marrying intensive quantitative analysis with rigorous fundamental due diligence. Quantitative metrics provide a strong analytical foundation, while fundamental research assesses a company’s vision, market position, and long-term growth potential. This hybrid model not only deepens investment intelligence, but also keeps Conviction Partners at the forefront of financial modeling trends—where alternative data and cutting-edge analytics are essential. By combining both methods, the firm uncovers unique opportunities that traditional approaches might miss, ensuring each investment is validated by comprehensive analysis.

High-Conviction Firms: Decision-Making and Performance

Decision-making at conviction-driven firms such as Assurance Associates is powered by firm confidence in their investment methodology. This confidence enables swift, agile responses to market shifts. Performance metrics show that when conviction is paired with meticulous analysis, outcomes are exceptional. By closely monitoring portfolio growth, Conviction Partners demonstrates strategic success—guiding investors towards impactful opportunities.

A prime example is Constellation Software Inc. (CSI). Under Mark Leonard’s visionary leadership, CSI has delivered a compound annual growth rate of 36.7%. Leonard’s unwavering focus on high capital returns, disciplined allocation, and reinvestment is transparent in the firm’s strategy. CSI’s acquisition model targets niche businesses overlooked by larger players—demanding a minimum 20% expected return. Leonard’s refusal to compromise these standards ensures above-average results.

CSI leverages financial resilience and operational expertise to successfully integrate new acquisitions, optimizing revenue and minimizing costs. This operational excellence underscores their conviction-led approach, marking CSI as a benchmark for investors seeking stable, robust growth.

Conclusion

In an increasingly complex investment ecosystem, conviction investing emerges as an effective strategy rooted in focus and in-depth analysis. By concentrating resources on select high-potential ventures, firms like Conviction Partners showcase how targeted investment can drive exceptional value creation. Alignment with legendary investor philosophies highlights the importance of patience and expertise in securing meaningful returns, even as broader markets shift.

The significance of concentration lies in its power to amplify results, though it requires vigilant risk management. Conviction Partners’ mastery of high-growth fields such as technology and biotech demonstrates how specialization, paired with strategic advice, raises portfolio company success rates. This calculated balance is vital for navigating today’s dynamic financial markets.

The fusion of quantitative and fundamental analysis is another distinguishing feature. This dual perspective ensures that investments are not only data-driven, but also deeply informed by market context and future potential. As seen in real-world stories like CSI, conviction investing delivers superior performance and enduring growth.

For investors ready to embrace focus and informed decision-making, conviction investing offers a proven path to transformative opportunities and significant returns in a changing market.