Understanding Series Seed Funding: Key Aspects and Considerations

Introduction

Navigating the early stages of a startup is both exhilarating and challenging. For Chief Marketing Officers (CMOs) and founders guiding seed-stage companies, understanding the defining traits of this phase is vital. These startups, typically built around innovative ideas and small, dedicated teams, focus on refining their product and validating their business model.

With limited revenue and evolving operations, the main objective is to transform a prototype or Minimum Viable Product (MVP) into a market-ready solution.

At this stage, raising capital is crucial. Startups explore various funding sources—personal savings, angel investors, venture capital firms, crowdfunding, and grants. Each source presents unique advantages and risks, making strategic selection essential. Moreover, a firm grasp of Series Seed funding terms and conditions helps founders maintain control while aligning with investor expectations.

A compelling pitch deck, strong financial projections, and strategic networking often determine success. Equally, choosing investors who share the company’s vision and long-term mission ensures enduring alignment and mentorship.

This article breaks down the core characteristics of seed-stage startups, explores funding sources, decodes Series Seed terms, and highlights key considerations for entrepreneurs ready to scale with confidence.

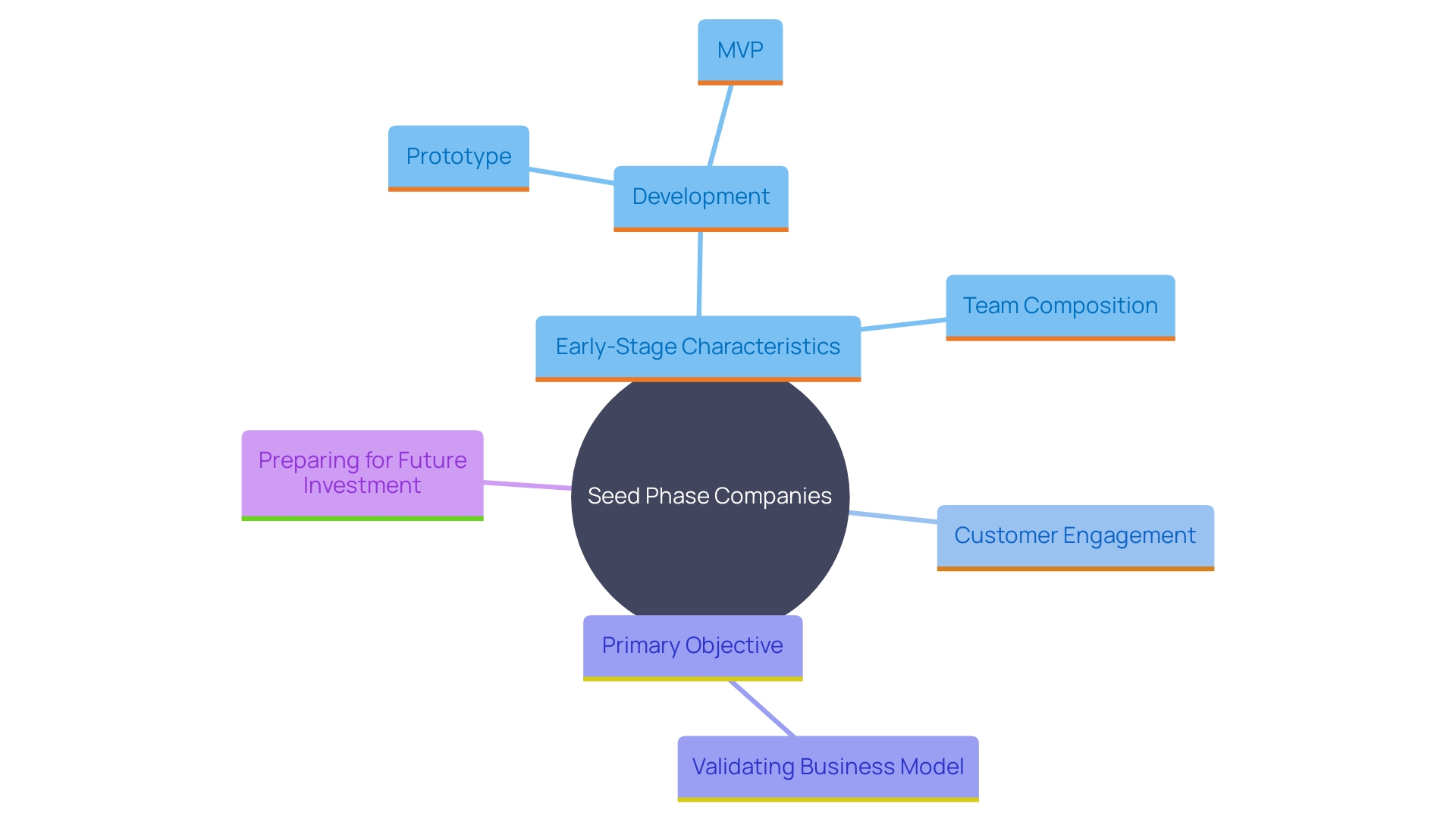

Characteristics of a Seed Stage Company

Seed-stage companies represent the formative phase of a startup’s journey. They are often defined by:

-

A strong idea and clear problem-solution fit.

-

A dedicated founding team of 5–7 members.

-

Early product development and MVP validation.

-

Initial customer feedback or small-scale market traction.

Approximately 70% of startups at this stage have a working MVP, 60% engage active users, and 40% have at least one paying customer. Their central goal is to validate the business model, confirming a repeatable formula of product → customer → sales → economics.

By achieving this validation, seed companies position themselves to attract future capital and demonstrate scalability potential to institutional investors. Intellectual property (IP) protection, clear product roadmaps, and proof of early traction serve as critical assets during this stage.

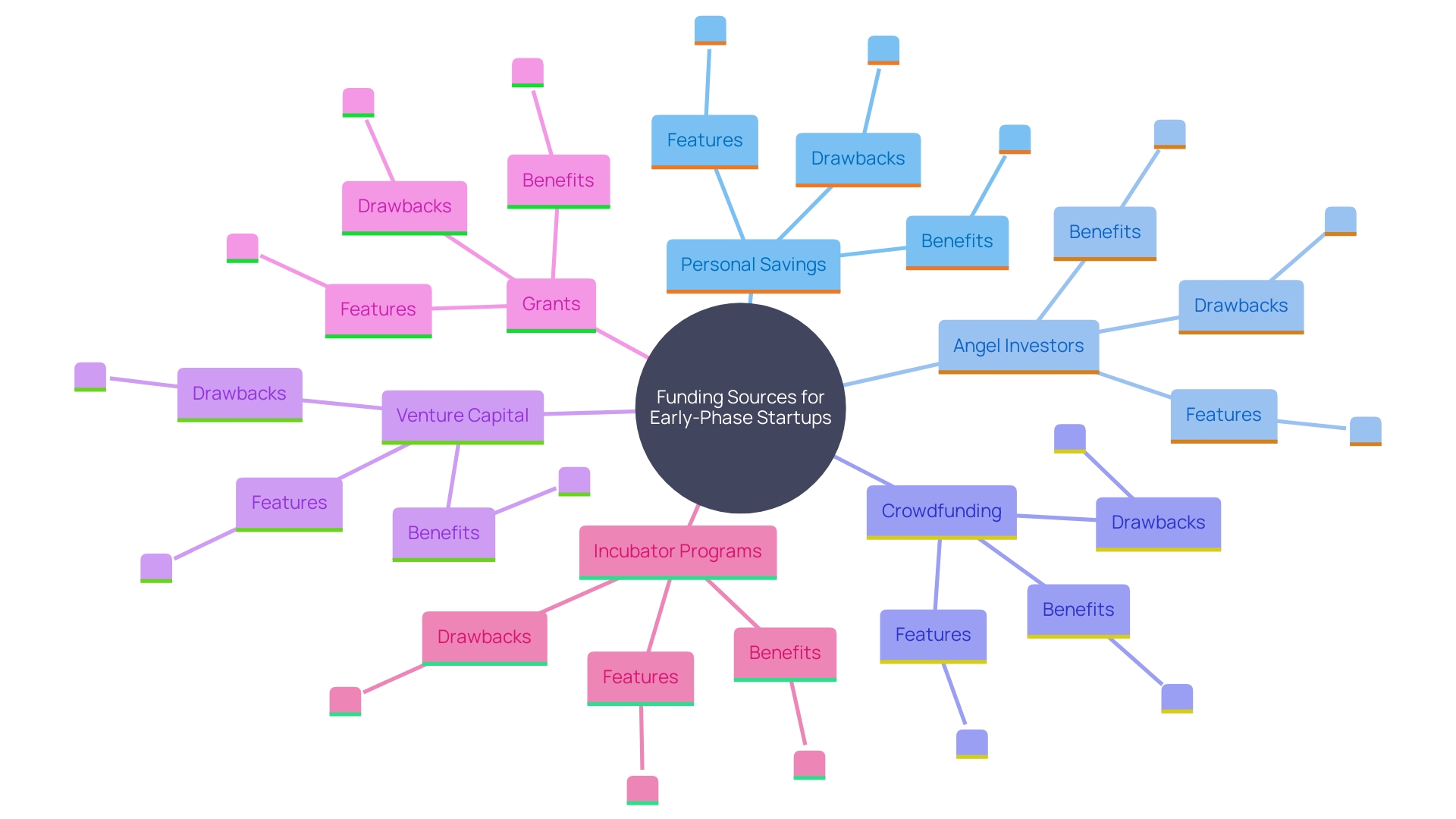

Funding Sources for Seed Stage Startups

Seed-stage startups have several pathways to secure capital:

1. Personal Savings & Friends and Family

Often the first step (known as pre-seed funding), this approach offers flexibility but limited capital. It helps founders prove concept viability before formal investment.

2. Angel Investors

High-net-worth individuals invest their personal funds and provide strategic mentorship. Angels bring valuable networks that accelerate market entry.

3. Crowdfunding Platforms

Platforms like Kickstarter or SeedInvest enable founders to validate market demand while raising funds from early supporters. However, success requires robust marketing and consistent campaign management.

4. Venture Capital Firms

Early-stage VCs specialize in Series Seed funding, offering structured investment, governance support, and access to larger networks. They focus on startups with scalable models and significant growth potential.

5. Grants & Incubator Programs

These offer non-dilutive capital and access to mentorship but are highly competitive. They often target specific industries such as sustainability, health tech, or AI innovation.

Understanding each option’s trade-offs—control vs. capital, flexibility vs. structure—helps entrepreneurs design a funding mix aligned with their vision and risk appetite.

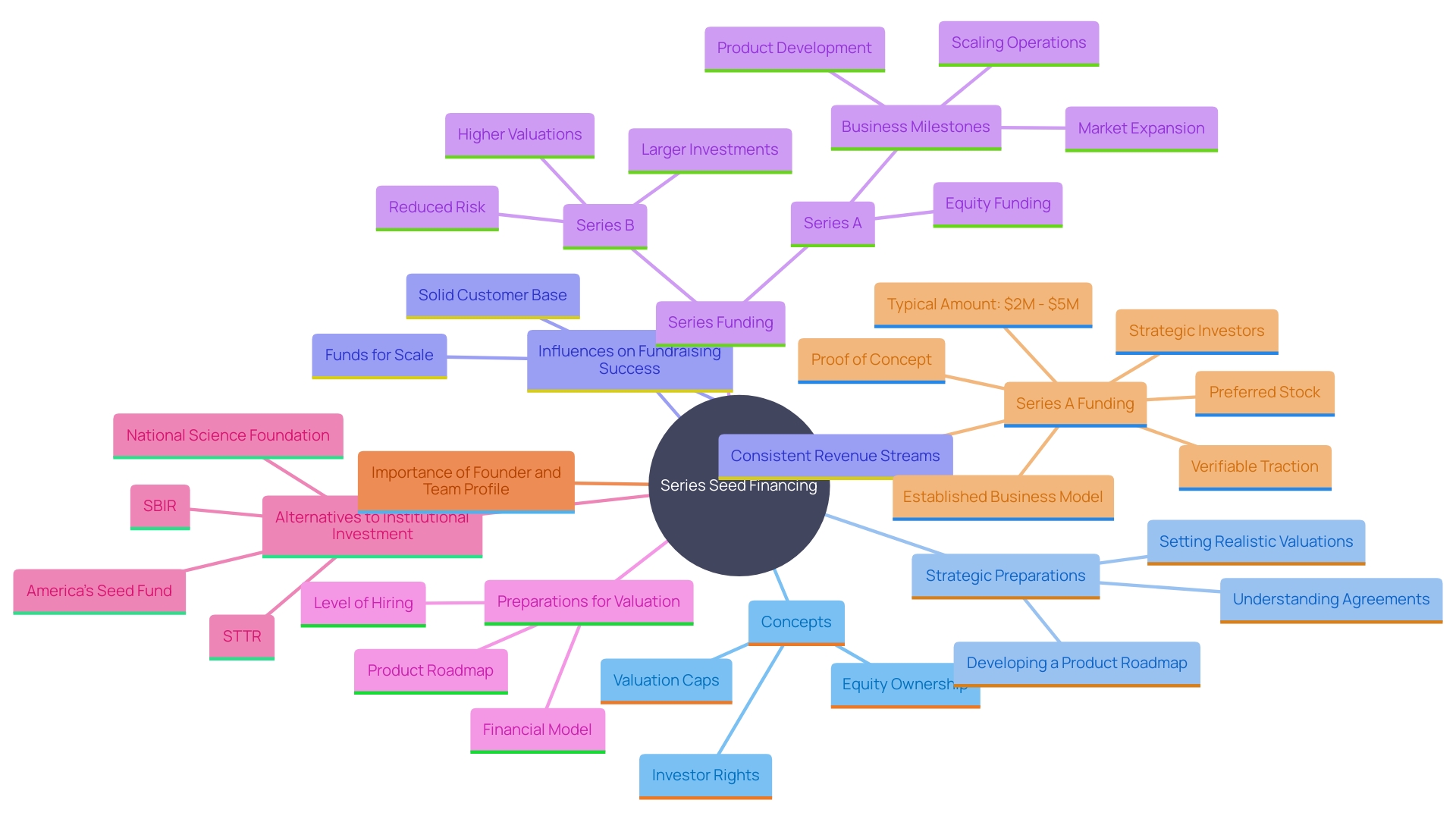

Common Series Seed Terms and Conditions

Series Seed financing represents the first significant institutional round in a startup’s life cycle. It establishes the relationship between founders and investors, governed by specific legal and financial terms:

-

Equity Ownership & Valuation Caps: Define investor ownership percentage and company valuation limits.

-

Liquidation Preferences: Outline how investors recover their capital in exit events.

-

Board Representation: Grants investors influence in governance decisions.

-

Information & Voting Rights: Ensure transparency and oversight in company operations.

-

Anti-Dilution Provisions: Protect investors from future valuation drops.

Corporate lawyer Irena Kramer from Gowling WLG emphasizes the importance of founders being well-informed on these clauses to maintain control while securing growth capital. Preparation is key—realistic valuations, a defined product roadmap, and a strategic hiring plan demonstrate credibility and foresight.

As seed deal sizes and valuations rise globally, investors expect detailed financial models and clear metrics for scalability. Mastery of Series Seed terms ensures smooth negotiations and establishes long-term trust with backers.

Considerations for Entrepreneurs Raising Seed Funding

Entrepreneurs must approach seed fundraising with precision, clarity, and confidence.

1. Craft a Compelling Pitch

Your pitch should articulate the problem, solution, market opportunity, and unique value proposition in a concise, story-driven format. Demonstrate real market validation, early traction, and team credibility.

2. Showcase Team and Market Readiness

Investors back people as much as products. Founders with industry experience (50%) and strong educational backgrounds (59% from top universities) tend to inspire more confidence.

3. Build Strategic Relationships

Engage advisors, mentors, and accelerators early. Their guidance can help refine your strategy and connect you to key investors.

4. Be Realistic with Valuations

Overvaluation can deter investors. Align your financial model with realistic growth assumptions and clear KPIs.

5. Select the Right Investors

Beyond capital, look for investors who offer domain expertise, network access, and cultural fit. Their involvement can shape the company’s trajectory long after funding closes.

Given today’s cautious investor climate, founders must exhibit transparency, operational discipline, and long-term vision to stand out.

Conclusion

The seed stage marks a defining chapter in a startup’s journey—one driven by innovation, determination, and validation. With a small, committed team and a working MVP, these companies must balance product development with fundraising strategy to scale effectively.

Understanding Series Seed funding equips entrepreneurs to make informed decisions on equity, investor rights, and valuations. By aligning funding strategies with long-term objectives, founders can attract partners who not only invest but also add strategic value.

A successful seed round demands more than capital—it requires a compelling narrative, sound financials, and aligned investors. With the right preparation and guidance, seed-stage startups can transition from promising ideas to scalable, market-ready ventures.

The potential for growth lies within reach. With the right mindset and execution, today’s seed-stage innovators can become tomorrow’s market leaders.