Understanding Focal VC: Insights and Market Dynamics

Introduction

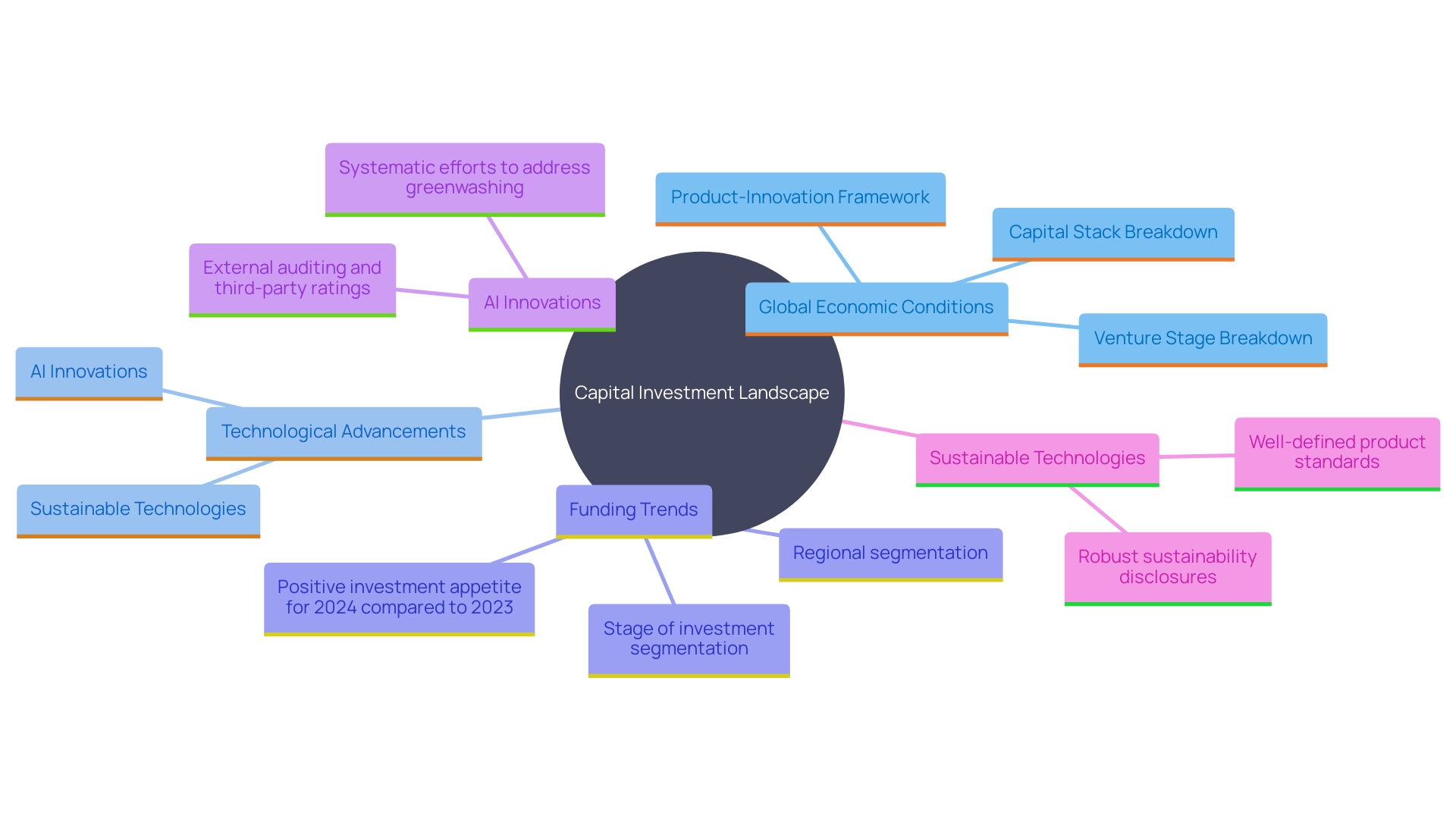

The venture capital (VC) landscape in 2025 continues to evolve against the backdrop of global economic realignment and rapid technological progress. Q1 2025 has revealed both challenges and opportunities, with stabilized deal flows and valuations returning closer to pre-pandemic benchmarks. Investors remain focused on technology-driven sectors, particularly artificial intelligence (AI), green technologies, and digital infrastructure. While global funding volumes remain lower than peak years, these sectors stand resilient, underscoring the industry’s enduring appetite for innovation.

At the same time, the venture market is responding to new workforce models that prioritize remote-first and hybrid productivity tools. This is essential as the industry faces historically low exit values and slower fundraising activity. Yet, optimism persists — fueled by the transformative potential of AI-powered efficiency and sustainability-focused innovation.

To succeed in this environment, investors must stay ahead of shifting trends and refine their strategies. This article explores the key venture capital insights from Q1 2025, regional highlights of global investment flows, the rise of innovative investment strategies, and the challenges of navigating evolving deal structures and valuations.

Key Trends and Insights from Q1 2025

The venture capital market in 2025 is undergoing structural shifts influenced by technology, capital flows, and macroeconomic dynamics. Reports show that stabilized valuations and renewed confidence are creating cautious optimism among VCs. This is supported by the continued rebound of public SaaS revenues and the accelerated adoption of AI across industries.

Q1 2025 funding data highlights AI and sustainability as the strongest investment magnets. Startups are channeling capital into generative AI, machine learning, climate tech, and green infrastructure, alongside cloud platforms and GPU-driven computing. Even as overall global venture funding dipped compared to 2021–22 highs, the AI investment boom and climate-focused innovation remain growth engines.

Meanwhile, the VC ecosystem is embracing remote collaboration platforms and hybrid productivity solutions, reflecting a shift in how workforces operate globally. Despite fundraising and exit values reaching multi-year lows, investors continue to believe in the long-term gains AI-driven solutions can unlock.

Stakeholders who understand these Q1 2025 venture capital patterns will be best positioned to capture opportunities and navigate risks in the funding landscape.

Global Investment Activity: Regional Highlights

Regional venture funding activity in 2025 shows differentiated but interconnected growth:

North America: Still the epicenter of global venture capital, led by Silicon Valley and New York. In 2024, San Francisco alone raised over $35 billion in VC funding, with late-stage deals climbing steadily. This resilience highlights North America’s continued dominance in AI, biotech, and SaaS investment.

Europe: Early-stage investment remains a strong focus, particularly in FinTech, deep tech, and health tech. With inflationary challenges and cautious spending, VCs in Europe are backing startups from accelerators and incubators that show durable growth potential.

Asia-Pacific: Southeast Asia continues to emerge as a cross-border investment hub, attracting international VCs and strategic acquirers. High-profile acquisitions and a surge in climate tech startups are positioning Asia as a global growth hotspot.

Latin America: Although the region faces liquidity constraints, AI is driving renewed optimism in 2025. Investors are eyeing traditional sectors ripe for digital transformation, highlighting the potential for technology-driven growth.

Investment Strategies and Priorities

Venture capital strategies in 2025 are moving decisively toward long-term resilience and sustainability. Investors are increasingly prioritizing companies with robust, scalable business models, integrating ESG (Environmental, Social, and Governance) principles into portfolio construction. Frameworks such as the Net-Zero Asset Owner Alliance (NZAOA) and NZAM initiatives remain central in guiding sustainable investment strategies.

Diversification across stages and industries is now a cornerstone. Investors are leveraging Fund of Funds (FoFs) models to broaden exposure while mitigating concentrated risks. This reduces vulnerability to downturns in specific sectors while ensuring participation in high-potential opportunities.

Emerging technologies — particularly AI, blockchain, clean energy, and green infrastructure — dominate VC priorities. PwC’s Global Investor Survey 2024 confirms that innovation capacity and ESG alignment are now primary decision drivers for capital allocation.

Case studies from the PRI highlight how asset managers are actively implementing net-zero roadmaps, providing practical blueprints for aligning portfolios with sustainability goals. This reflects a wider shift toward responsible investing in 2025, where returns are balanced with global impact.

Navigating Market Changes: Deal Structures and Valuations

In 2025, navigating deal structures and valuations requires flexibility and sharp due diligence. Early-stage funding has shown growth, while late-stage deals remain under pressure. Investors are increasingly structuring deals with milestone-based funding, convertible instruments, and adaptive equity agreements to reflect shifting market conditions.

Valuation models are also evolving. Instead of revenue-focused metrics alone, VCs are prioritizing customer retention, market traction, and profitability pathways. Cloud and AI companies, once focused on aggressive growth, are now judged on their ability to scale efficiently and sustainably.

With fewer funds in circulation, competition for capital has intensified, making rigorous startup due diligence indispensable. This includes assessing founding teams, scalability, and exposure to macroeconomic risks. The result is a more selective environment, but one where disciplined investors can identify standout opportunities.

As the venture market in 2025 continues to rebalance, flexibility, innovation, and sector-specific insights will define success in valuations and deal-making.

Conclusion

The venture capital industry in Q1 2025 is marked by recalibration and resilience. Stabilized deal flows, valuation resets, and renewed confidence in AI and sustainability investments highlight the industry’s capacity to adapt and thrive.

North America leads global VC activity, Europe focuses on early-stage innovation, Asia-Pacific accelerates as a cross-border hub, and Latin America shows early signs of AI-led recovery. These regional dynamics illustrate the need for investors to remain both global in perspective and local in execution.

Investment strategies are increasingly geared toward sustainable, diversified portfolios. With ESG integration, AI dominance, and green technologies shaping the next wave of disruption, 2025 stands as a pivotal year for responsible and forward-looking venture capital.

To navigate shifting deal structures and evolving valuations, investors must adopt rigorous due diligence and adaptable strategies. The winners in this new VC era will be those who combine flexibility with data-driven insights to capture opportunities in an ever-changing global landscape.