Crafting an Effective Product-Market Fit Survey: A Step-by-Step Guide

Introduction

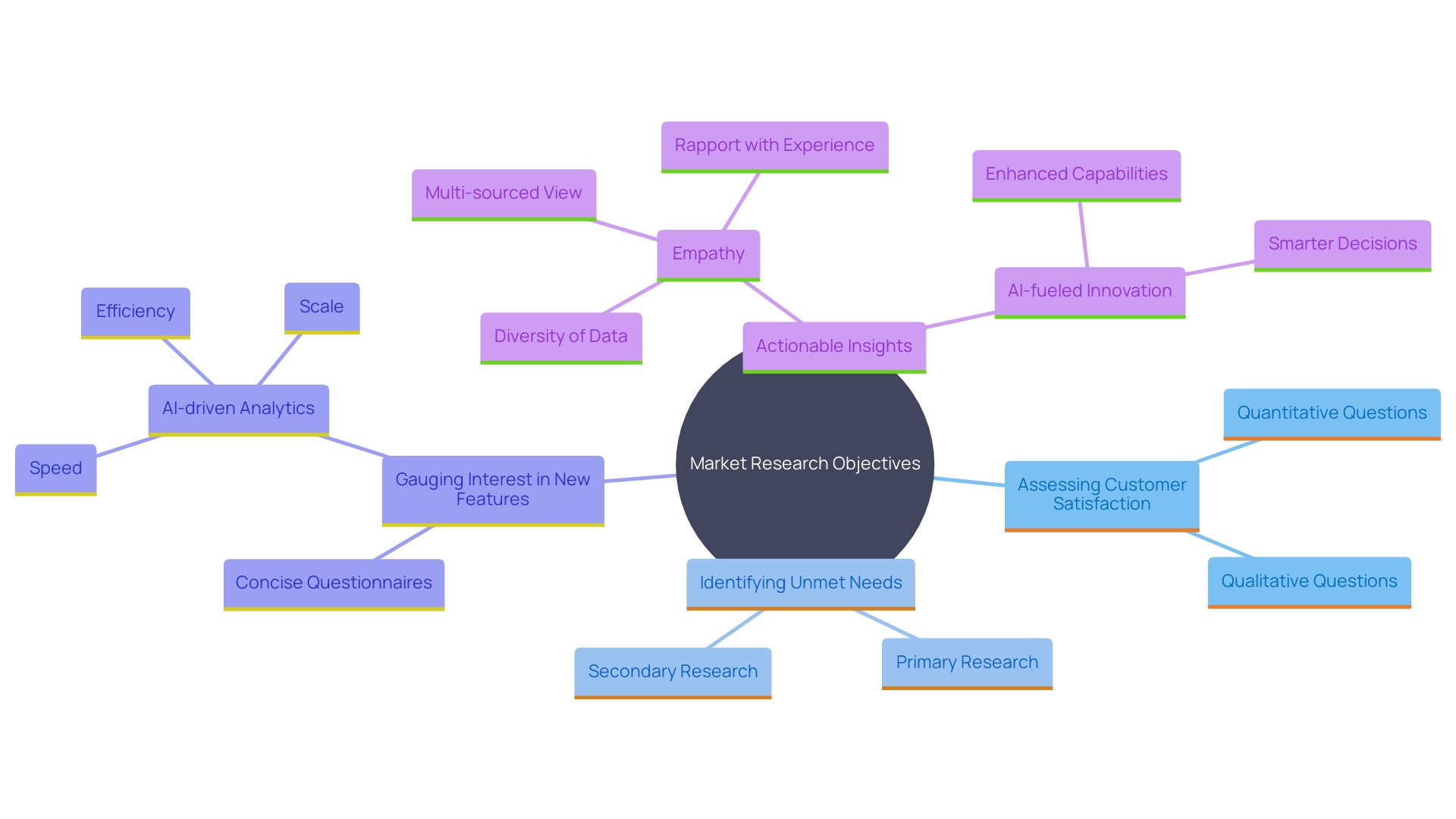

In today’s hyper-competitive digital marketplace, achieving product-market fit (PMF) is one of the most critical milestones for any organization. For Chief Marketing Officers (CMOs) and product leaders, designing a Product-Market Fit Survey can unlock invaluable insights into customer needs, satisfaction, and loyalty.

An effective PMF survey does more than gather feedback—it bridges the gap between assumptions and reality. By understanding your target audience, framing the right questions, and applying rigorous data analysis, businesses can transform feedback into data-driven strategies that enhance retention, refine messaging, and accelerate growth.

Understanding Your Target Audience

The cornerstone of any meaningful survey lies in knowing who you’re talking to. Before drafting a single question, take time to analyze audience demographics, motivations, and pain points.

Ask:

-

Who are your customers?

-

What challenges are they trying to solve?

-

How does your product compare to competitors in their eyes?

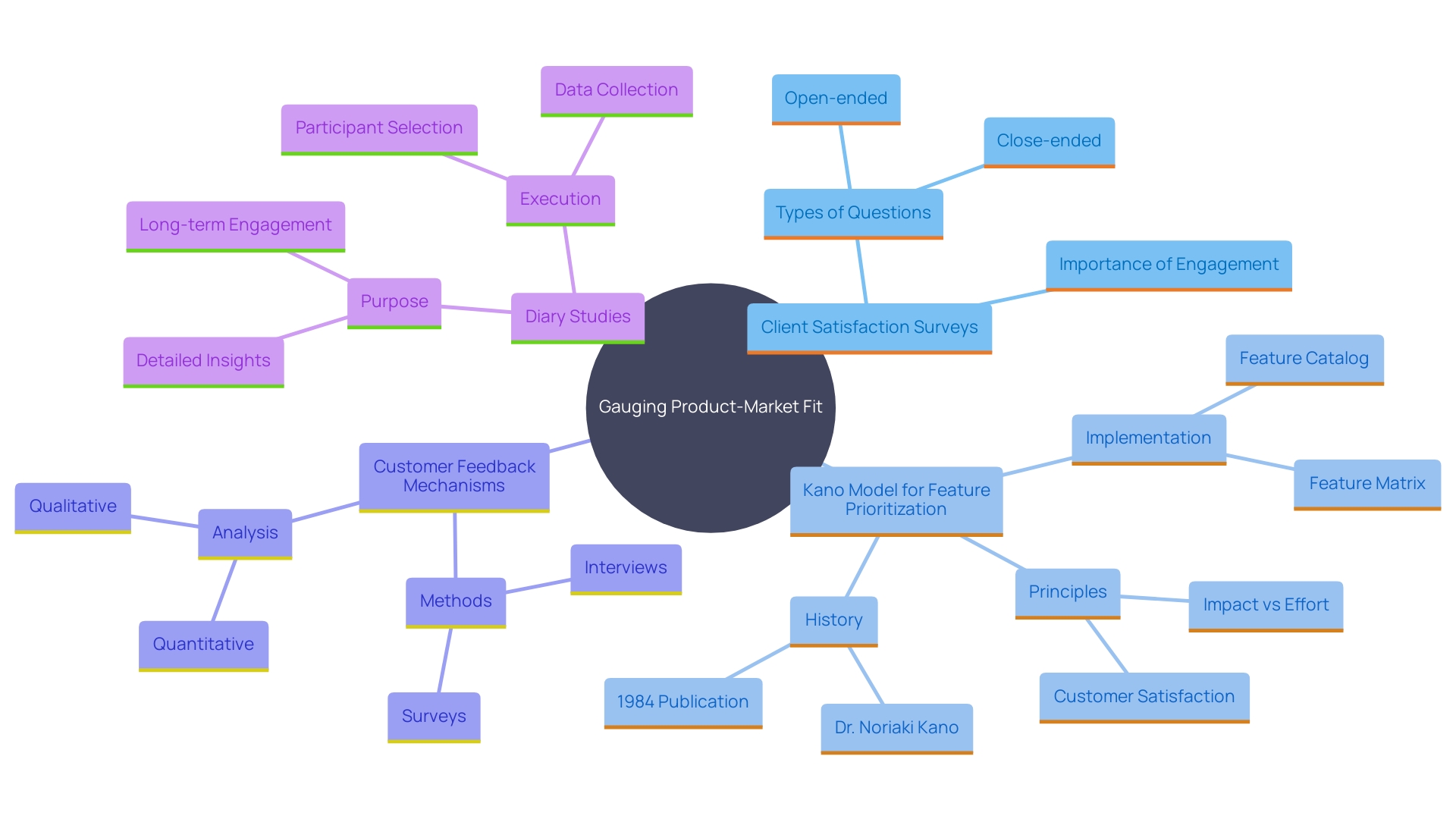

Engage directly with existing users through interviews, focus groups, and behavioral data. These interactions reveal how customers perceive value—and highlight opportunities for improvement.

Revisiting existing data regularly can also expose evolving trends. As markets shift, this continuous loop of understanding helps ensure your survey remains relevant and your product stays aligned with future needs.

Remember, a PMF survey is not just a questionnaire—it’s a conversation that deepens your understanding of your users.

Crafting Your Product-Market Fit Survey

Begin with clarity. Define your primary objective—whether it’s to measure satisfaction, test new features, or identify unmet needs. Your goal determines your question types and the insights you’ll extract.

Key Elements of Effective Survey Design

-

Use a mix of question types:

Combine quantitative metrics (rating scales, multiple choice) with qualitative prompts that let respondents express thoughts freely. -

Keep it concise:

A focused survey ensures higher completion rates and more accurate results. -

Maintain logical flow:

Group questions by theme (e.g., usage, satisfaction, improvement areas) for better respondent engagement. -

Leverage modern tools:

AI-driven analytics can automatically cluster responses, highlight trends, and reduce manual analysis time.

High completion and engagement rates signal that your survey resonates—both in content and design. Treat each response not as data, but as an insight into how your audience truly experiences your product.

Key Questions to Include in Your Survey

The best Product-Market Fit surveys balance simplicity with depth. Each question should reveal something actionable.

Here are key categories and sample prompts:

-

User Experience & Satisfaction

-

How disappointed would you be if you could no longer use our product?

-

What problem does our product help you solve the most?

-

-

Feature Importance

-

Which features do you find most valuable?

-

Are there any missing capabilities that would improve your experience?

-

-

Loyalty & Advocacy

-

How likely are you to recommend our product to a friend or colleague? (NPS)

-

What’s the main reason for your score?

-

-

Behavioral Insights

-

How often do you use the product?

-

What alternatives have you considered?

-

Applying frameworks like the Kano Model—which classifies features as basic, performance, or excitement attributes—helps you prioritize what drives real user satisfaction.

As John Hughes observed, “Customers who value their relationship with a brand are more willing to give detailed feedback.” Companies like Amazon and Ritz-Carlton have mastered this by nurturing trust and engagement through every interaction.

For deeper insights, incorporate diary studies—where participants record daily interactions with your product—to map longitudinal patterns in satisfaction, friction, and feature use.

Analyzing Survey Results

Once responses are in, the real work begins. A well-executed analysis can turn hundreds of data points into a strategic roadmap.

Step 1: Clean & Organize Data

Remove duplicates, categorize responses, and tag themes for structured analysis.

Step 2: Identify Key Patterns

Look for repeated sentiments, emerging pain points, and statistical correlations (e.g., satisfaction vs. retention).

Step 3: Visualize & Interpret

Use data visualization tools to communicate insights clearly across teams.

As seen in Industry 4.0 digital transformation case studies, integrating multiple data sources yields clarity and efficiency—allowing teams to move from data collection to strategic implementation faster.

AI and advanced analytics now make this process even more powerful, automating pattern recognition and surfacing hidden opportunities. The result? Faster decisions and sharper alignment between product, marketing, and customer needs.

Conclusion

In a world where customer expectations evolve rapidly, understanding your audience is non-negotiable. Crafting a Product-Market Fit Survey grounded in data and empathy allows CMOs to measure true resonance between product and market.

By setting clear goals, asking the right mix of questions, and applying modern analytics, businesses can uncover insights that guide everything—from feature development to messaging strategy.

Frameworks like Kano, methods like diary studies, and technologies like AI analytics empower organizations to move beyond guesswork—toward continuous, evidence-based improvement.

Ultimately, the Product-Market Fit Survey isn’t just a research tool; it’s a strategic compass. It helps leaders identify what customers love, what they tolerate, and what they wish for—turning that knowledge into a roadmap for sustainable growth.

Ready to uncover your product’s true market fit?

Contact us today to design a data-driven survey strategy that turns insights into measurable success.