Analyzing Trends and Opportunities in the Venture Capital Market 2025

Introduction

The venture capital (VC) market in 2025 is undergoing a pivotal transformation, presenting both challenges and unprecedented opportunities. Fueled by technological breakthroughs, shifting global economies, and evolving consumer behaviors, the landscape demands agility and foresight from investors. Despite geopolitical tensions and economic uncertainties, optimism is returning, driven by the stabilization of late-stage startups and the resurgence of valuations to pre-pandemic levels.

Two areas stand out: Generative AI and sustainability tech. These sectors have consistently dominated top deals, signaling their critical role in shaping the next wave of global innovation. Meanwhile, early-stage investing has proven remarkably resilient, focusing on foundational technologies like AI, robotics, and circular economy platforms that promise both scalability and long-term impact.

With inflation easing, interest rates decreasing, and the U.S. economy showing renewed strength, conditions are becoming fertile for entrepreneurs to refine business models and pursue sustainability-driven growth. For investors, the ability to stay ahead of emerging trends requires AI-powered market intelligence, strong due diligence frameworks, and strategic collaborations with accelerators and incubators.

In this article, we analyze the latest venture capital trends, emerging opportunities, competitive dynamics, and best practices for market analysis in 2025, equipping investors with the insights needed to thrive in an evolving VC ecosystem.

Understanding Market Trends in Venture Capital

The investment environment is in constant flux, shaped by technology adoption, macroeconomic adjustments, and changing consumer behavior. According to Kearney’s latest report, venture capital’s resilience is being tested by factors such as geopolitical instability and Federal Reserve interest rate shifts. Yet optimism persists—particularly with late-stage companies stabilizing and valuations normalizing after years of volatility.

Key Market Shifts in 2025:

-

Generative AI & Sustainability Tech: Generative AI and green-tech startups dominate top funding rounds, signaling investor confidence in AI-driven productivity gains and climate-positive solutions.

-

Resilient Early-Stage Funding: While global VC funding pulled back in 2023, early-stage startups continue to attract capital, especially in AI, robotics, and healthtech.

-

Macroeconomic Easing: Lower inflation, reduced interest rates, and stronger stock performance are boosting investor confidence and liquidity.

-

Return to Pre-Pandemic Norms: Deal activity mirrors 2019 levels, indicating a reset in expectations and healthier long-term growth patterns.

This environment creates space for entrepreneurs to build durable business models and for investors to strategically allocate capital into high-potential opportunities.

Identifying Emerging Opportunities

The best opportunities often emerge from disruption in conventional industries or from startups tackling unmet consumer and enterprise needs.

Sectors Driving the Future of Venture Capital:

-

Generative AI: Transforming workflows across industries with automation, personalization, and content creation.

-

Sustainability & Circular Economy Platforms: Enabling resource efficiency, recycling, and material exchange ecosystems.

-

Robotics & Automation: With $90 billion in funding since 2019, robotics continues to accelerate manufacturing, logistics, and healthcare solutions.

-

Climate Tech & Green Infrastructure: Essential for meeting global carbon targets and aligned with government-backed incentives.

Methods for Spotting Emerging Opportunities:

-

AI-Driven Market Research: Using predictive analytics for identifying high-growth subsectors early.

-

Industry Engagement: Attending conferences, pitch events, and expert panels to capture first-hand trend insights.

-

Cross-Border Investments: Recognizing opportunities in emerging markets where innovation is accelerating.

By combining AI-based research with human expertise, investors can consistently stay ahead of the curve and uncover nascent but scalable opportunities.

Evaluating the Competitive Landscape

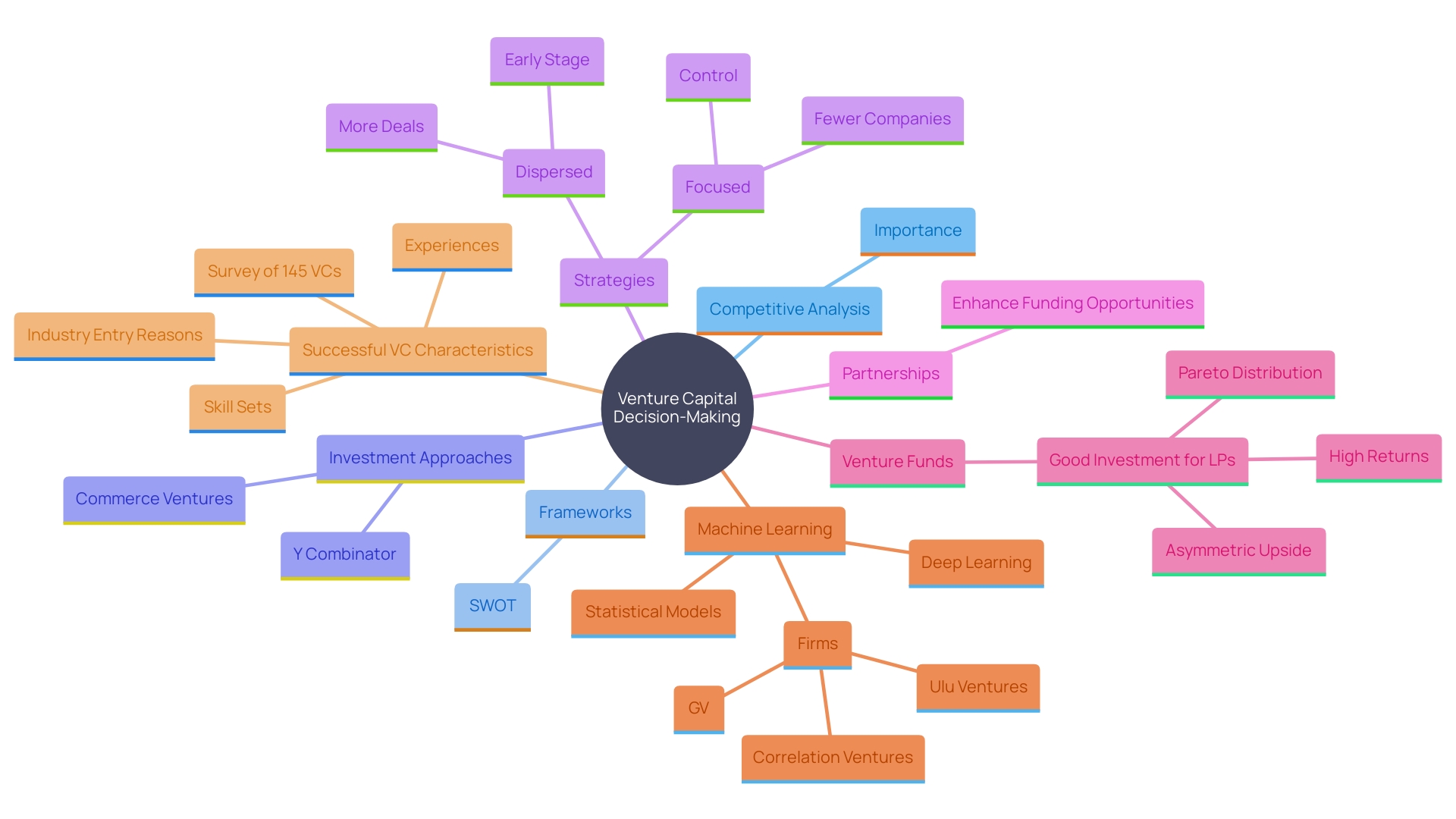

Success in venture capital requires not just identifying opportunities but also understanding the competition.

Key Evaluation Strategies:

-

SWOT Analysis: Assess strengths, weaknesses, opportunities, and threats for both startups and VC peers.

-

Fund Size Dynamics: Smaller funds often outperform due to a higher likelihood of outlier wins and lower win-rate thresholds.

-

Ecosystem Mapping: Tracking partnerships between startups, corporates, and accelerators to find synergistic investment angles.

-

Case Studies:

-

Y Combinator: Blends funding with founder education, proving that strong support structures amplify startup outcomes.

-

Commerce Ventures: Uses a thematic investment approach, focusing on areas where they bring maximum strategic value.

-

As Sid Ramtri emphasizes, investors must monitor both financial and strategic metrics, ensuring not only strong returns but also measurable progress in product development and collaboration.

Best Practices for Venture Capital Market Analysis

To thrive in 2025’s VC environment, investors must adopt disciplined and adaptive analysis frameworks.

Best Practices Include:

-

Rigorous Due Diligence: Conduct detailed financial modeling, risk assessment, and industry validation.

-

AI-Powered Analytics: Leverage machine learning for trend forecasting and predictive evaluation.

-

Partnership Building: Strengthen relationships with accelerators, incubators, and co-investors for improved deal flow.

-

Dynamic Risk Management: Apply metrics such as MOIC (Multiple on Invested Capital) to assess long-term fund performance.

-

Continuous Learning: Stay updated with emerging methodologies, regulatory changes, and investor sentiment.

As Dropbox DocSend’s Justin Izzo highlights, after years of market stress, renewed investor confidence is paving the way for more dynamic VC activity. Those who maintain preparedness and adaptability will outperform peers.

Conclusion

The venture capital market of 2025 represents a blend of stabilization and disruption. While global uncertainties persist, the rebound of valuations and resilience of early-stage startups signal renewed confidence. Generative AI, sustainability, robotics, and circular economy platforms are reshaping the future of innovation, offering fertile ground for investors who remain proactive and informed.

Success in this market requires more than capital—it demands strategic foresight, rigorous due diligence, AI-driven insights, and strong ecosystem partnerships. By evaluating emerging opportunities, analyzing competition, and adopting best practices, investors can navigate uncertainty while capturing outsized returns.

As investor optimism strengthens, those who seize the moment now will position themselves as leaders in the next wave of venture capital growth.